The first half of the year has now ended with the stock market having delivered positive returns. The S&P 500 stock index rose a solid 6.1% while the Dow Jones provided a modest 1.5%. And after GDP growth of -2.9% in the first quarter, Q2 GDP growth is forecast to be about 3%. Looking ahead, in our view, there are two key variables that will determine the future direction of the stock market: interest rates and corporate earnings.

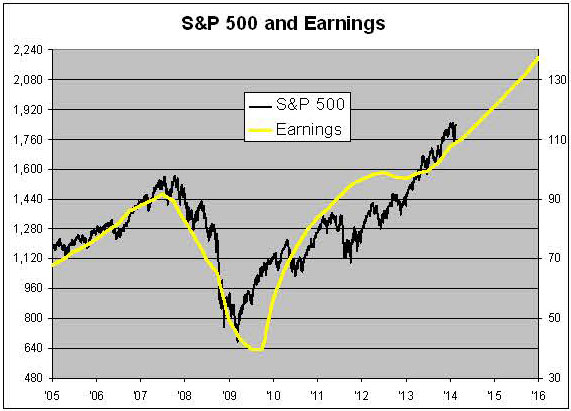

First, interest rates must stay low which is likely through at least the end of the year as the Fed continues to taper (see fixed income comments below). Low interest rates help companies generate earnings growth through lower borrowing costs. Second, Corporate profits are also an important contributor for further price appreciation this year and next. Profits, as always, will be crucial because stock prices almost always track earnings. The following graph shows this close relationship:

Source: Crossing Wall Street

For stocks to advance from these levels, corporate profits must meet or exceed expectations. Investors are currently expecting around 7.6% earnings growth in 2014 and 10.0% in 2015. Both numbers seem achievable; however, the 2015 forecast is dependent on the economy growing at near 3%.

| S&P 500 Earnings Estimate | Year/Year % Growth | P/E on Estimated Earnings | |

| 2013 (Actual) | $107.30 | 10.8 | 18.3 |

| 2014 (Projected) | $115.47 | 10.6 | 17.0 |

Second quarter earnings growth, thus far, has been reported at +6.7% along with 3% revenue growth. Sluggish revenue growth could be a real problem for companies trying to achieve earnings targets. In fact, many companies that forecasted weak revenue growth on their Q2 earnings call saw their stocks punished as a result.

Can P/E multiple expansion (increases) help stock prices even if earnings growth disappoints? We think this is unlikely since P/E ratios soared in 2013, which helped propel the stock market to huge gains (30% for the S&P 500 and 26.5% for the Dow.) Although P/E ratio levels are currently reasonable, it is unlikely they will expand significantly given our slower growth economy and average earnings growth projections.

One of the bright spots of 2014 has been high dividend paying stocks. As a result of rapid growth in dividends combine with investors’ thirst for income, stocks offering high and growing dividends have become the new darlings of investors. Ten percent growth in dividends is forecast for 2014 in S&P stocks. Savers and investors continue to be frustrated by extremely low interest rates. Many are now using these stocks as an income generator in lieu of bonds. Our dividend growth strategy may be appropriate for investors wanting a conservative equity approach combined with above average dividend yields. However, dividend-paying stocks are not a substitute for bonds and we remain convinced that investors should maintain an overall equity allocation aligned with their risk tolerance.

Sources: Factset and Standard and Poors Down Jones Indices

Fixed Income

Currently, we find few signs inflation will drive rates higher, but fixed income markets may suffer from indigestion later this year.

A lack of inflation means rates may remain painfully low for savers as the Federal Reserve continues its tapering of Quantitative Easing. Federal Reserve Chair Janet Yellen has indicated that unemployment will cause her to error on the side of restraint as the taper continues. Tapering is not the same as tightening and rates have not yet come under pressure.

Remarkably narrow credit spreads and exceptionally low interest rates make us cautious on bonds. We continue to believe that bonds serve a purpose in most portfolios by dampening volatility. However, the returns available on high quality short and intermediate bonds no longer provide sufficient income to support client objectives.

While we see continued demand for income producing investments in the near term, the bond market could come under substantial pressure for over the next few years. Four years into the Dodd-Frank banking regulation implementation, banks are now limited in ability to take risk in support of making a market in fixed income investments and this may further impact markets as rates rise and the marginal buyer loses interest.

For the reasons cited above, we are wary at this point of purchasing higher risk “bond imposters” or securities offering greater levels of income, such as high yield bonds, bank loans and private REITs, at the cost of quality liquidity. These investments have seen impressive returns over the past few years but have characteristics (equity-like and illiquid) that could make them unpredictable or even dangerous. Please feel free to contact us to learn more about our current bond management practices.

What is Core-Satellite investment approach? Why use it?

At Clearview Wealth Solutions we use a proven approach to investment management called Core-Satellite. Our goal through this proprietary strategy is to benefit our clients with a more thoughtful planning process that includes location management, ongoing tax-loss harvesting, holding period management and tax lot management. For additional information on our Core-Satellite approace, please click on the link below or contact us at Clearview Wealth Solutions at Steve@clearviewws.com or Core-Satellite@clearviewws.com.