BULL MARKET TOP CHECKLIST

________________________________________________________________

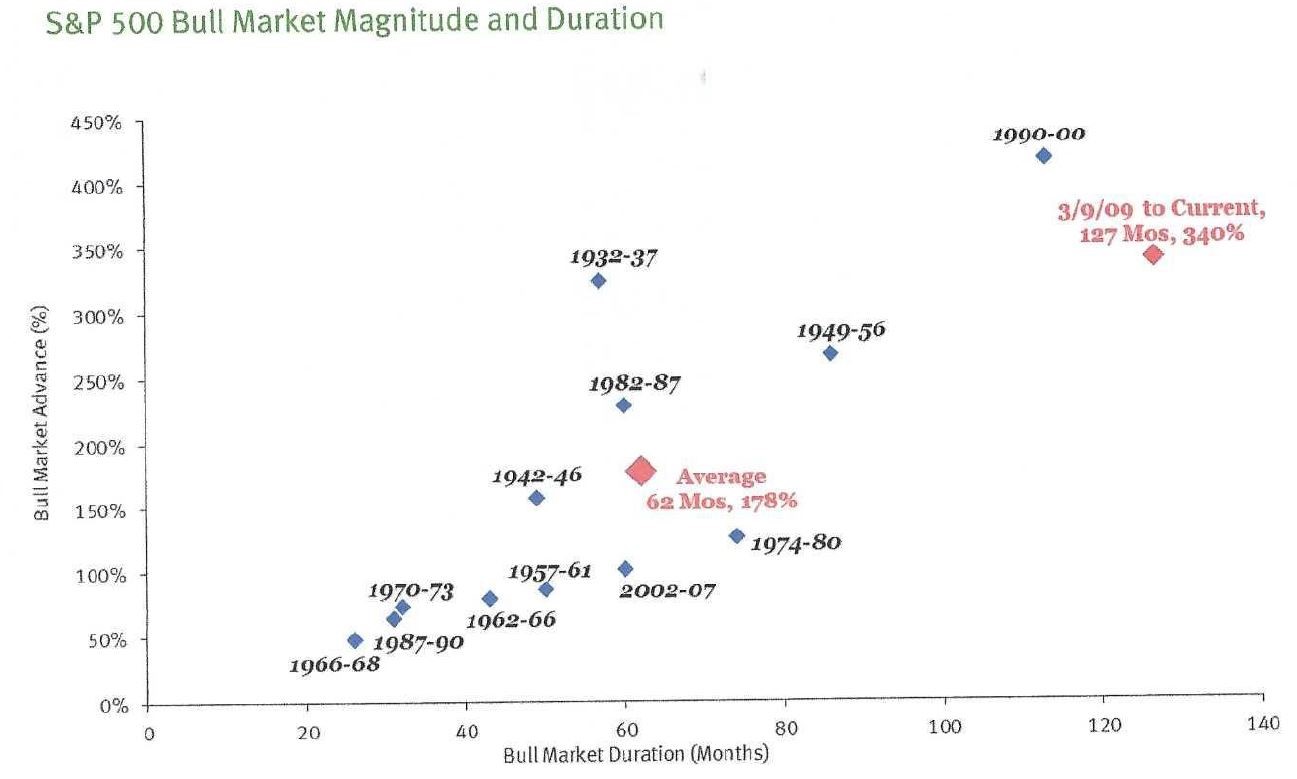

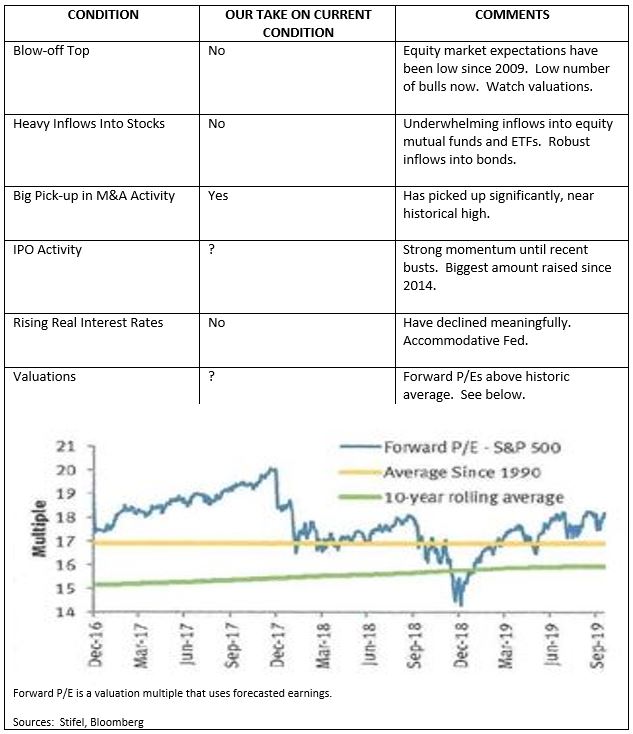

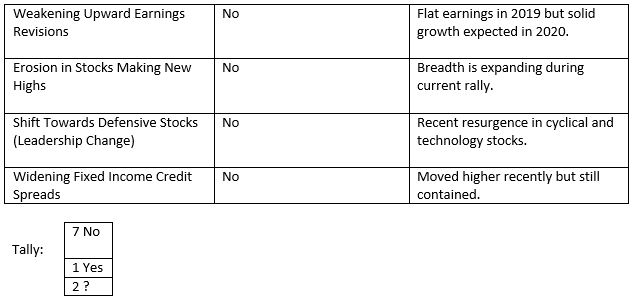

Source: Stifel, Strategas Research Partners Both the magnitude and duration of this bull market have been impressive as shown above. More and more investors are forecasting an end to this bull, but bull markets don’t die of old age. Rather, a number of conditions are usually present which signal the end of the bull. Here are ten of these conditions and our thoughts:

As the tally shows, most bull market top conditions are not present. Stocks broke out of their 21-month trading range last week and continue to surprise the skeptics. This bull market has the potential to be the strongest on record-it’s already the longest. |