This quarter’s earnings season is off to a good start as 81% of companies reporting have beat EPS estimates, and 80% are beating revenue forecasts. We remain focused more on what companies will say on the conference calls about four key areas and view these factors as near-term stock market risks: 1) supply chain bottlenecks; 2) climbing oil prices; 3) inflationary labor costs; and 4) slowing economic growth in China. Although we remain optimistic on U.S. stocks and still think we are in the early/mid-cycle stage of the bull market, this energizer bunny stock market will eventually pause. This earnings season has the potential to be the catalyst.

According to Barron’s Fall 2021 Big Money Poll, investors think the three biggest risks the stock market will face in the next six to twelve months are fiscal/monetary policy blunders, inflation, and rising bond yields. Fed tapering, expected to start in December, is a distant seventh. Even further down the list is a Covid resurgence-only 3% of respondents said that is a concern.

The Baron’s poll finds 50% of managers bullish on equities in the next 12 months, down from 67% in the spring. Twelve percent are bearish, up from 7% in the last survey. The remaining investors are neutral. According to Bespoke Investment Group, net bullish sentiment is at its lowest point since April 2020 – during the beginning of the national lockdown. Given the sharp rally in stock prices since the market low in early October (up 4.5%), sentiment once again came through as a contrarian indicator.

EARLY SIGNS OF EASING INFLATION ?

If you have been visiting the grocery store, gas pump, an online retailer, or anywhere else, you have noticed a sharp rise in inflation. In fact, the consumer price level has increased 5.4% in the last 12 months, and 6.5% on an annualized basis so far in 2021. It hardly feels “transitory.” But there are early signs that the inflation rate may be peaking. Here are three indicators showing the rate of inflation may be headed lower:

First, the single biggest headwind for the global supply of goods is shipping costs which have been soaring to uneconomic levels in the spot market. The most ships are on order now since 2011, accounting for nearly 10% of the current container fleet by ship count. We may already be starting to see some signs of easing in shipping prices. Last week the Financial Times reported that spot rates of shipping from China to the U.S. have been cut in half since their peak in September.

Second, combining the manufacturing and service sectors, 74 commodities were up in price recently and six were down for a net of 68. The peak monthly reading on combined basis was in May at 93. Peaks in the commodity survey have often coincided with peaks in the CPI. Of course this could reverse and head higher in the months ahead, but based on prior experiences, once the net number of commodities rising in price peaks, it usually starts to roll over.

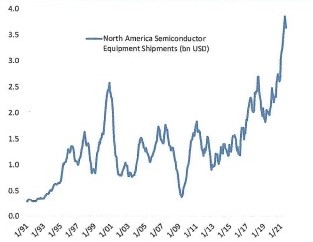

Third, while the semi industry is supply constrained for now those constraints won’t be permanent. As new supply comes online the shortage of chips will alleviate. As shown below, sales of semiconductor equipment, a key input for expanding capacity of chip production, have soared:

SEMICONDUCTOR CAPEX IS SOARING

Source: Bespoke Investment Group

Other signs of inflation have not cooled yet, so it is a tug-of-war between dozens of inflationary indicators. But these three gauges are giving us hope that inflation measures are peaking.