The Q4 earnings season is about halfway over and it has been mixed at best, in our view. Companies are beating EPS estimates at a normal clip, but revenue growth has been disappointing. This can lead to both lower profit margins and slower earnings growth ahead. Cost cutting is helping reported earnings but you can’t keep cutting costs to prosperity.

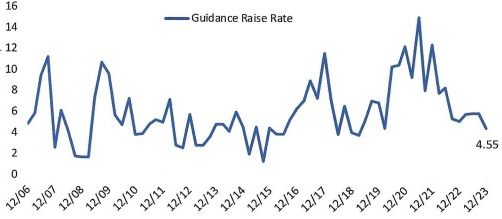

Many companies with disappointing guidance have seen their share prices slammed on earnings announcement day. And the guidance raise rate is slowing sharply. Below is a graph of guidance raise rates going back to 2006 (in percent). The raise rate hasn’t been this low in about five years at 4.55%.

Source: Bespoke Investment Group

Do companies see something we don’t see or are they being overly conservative? Given the economy still looks reasonably strong (see next bullet point) we think guidance will improve as the year progresses.

The recession that many economists forecast for 2023 never came. Many of those same economists now say 2024 is the year. We disagree. We think the chance of a recession, even mild, is less than 25%. Here’s why:

The recently released Q4 GDP report showed GDP rising much faster than expected, up 3.3% at an annual rate versus 2.0% expected and 2.4% forecast by the Atlanta Fed’s GDPNow tracker (which is considered the gold standard for real-time GDP tracking). 2023 turned out to be the year of surprises: growth stayed high, labor markets remained strong, and the rate of inflation dropped back to target.

January non-farm payrolls were announced last Friday and crushed estimates, rising at the fastest pace in a year – 335,000 new jobs. And inventories remain very low to sales which suggests inventory re-stocking can be a tailwind for GDP for some time to come. The bottom line: growth has remained strong despite Fed tightening and slowing inflation. A strong economy would help earnings growth and hopefully give managements more confidence and guide higher for 2024. We expect economic growth to slow this year but given its momentum, we think a recession can be avoided.

THE TECH BULL MARKET ROLLS ON

The current bull market started in October 2022 and is up about 38% (S&P 500) so far compared to 114% for an average bull market. So, based on averages, we have a long way to go. Bull markets are typically long and steady. Bear markets are typically short and steep.

The ten largest stocks in the S&P 500, including the Magnificent Seven, now account for 33% of the total market cap. The investment world increasingly lives by the mega-caps and dies by the mega-caps. It is still early in the year, but look at the disparity in performance through yesterday:

NASDAQ 100 (mega-cap tech heavy): 5.5%

S&P 500 (also mega-cap and tech heavy): 4.7%

Equal Weight S&P 500 (broader market): 0.0%

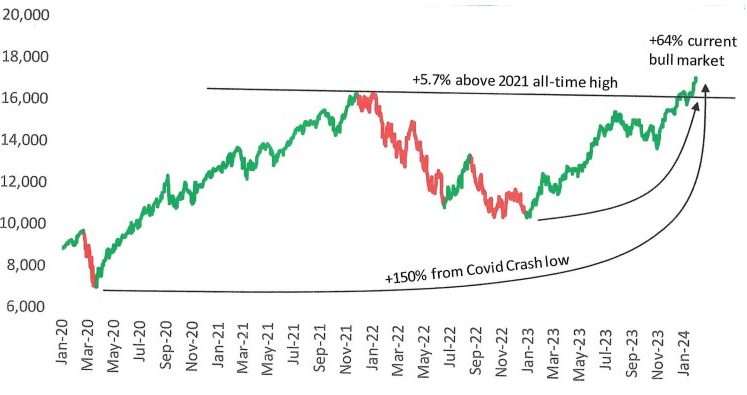

The graph below shows the incredible performance of the NASDAQ 100 off the Covid low:

Source: Bespoke Investment Group

Here are a few noteworthy stats for the NASDAQ 100 since its bull market began:

– up 64% during its current bull market

– up 150% from its Covid crash low

We should also note one-half of S&P 500 stocks are down this year. So it is clear the market has not broadened out in 2024 which is disappointing. An extended bull market will need to see stocks besides tech join the rally. We think that will happen but there are no guarantees. Bears point to this narrow bull market as a reason not to trust it.

Bears cite valuations as their number one concern. Indeed the S&P 500 is trading at a rich 24x 2024 estimated earnings. However, on an equal weight basis, multiples are not nearly as extended at 18x and are right at pre-Covid levels.

We remain bullish but will feel more comfortable when the rally broadens.