We got a favorable CPI print for May last week. Core CPI decelerated to the slowest monthly pace in almost three years. Core CPI ex-rent dropped month-over-month and is now below a 1% annual rate of change on both a three month and 12 month basis. This was arguably the best (lowest) inflation print we have gotten since the pandemic.

Fed Chair Powell “welcomed today’s inflation reading” but “hopes for more.” The median FOMC projection now sees just one rate cut this year while most economists expect two cuts. However, both the Fed and Wall Street economists expect 2025 to finish with rates 150 basis points below current levels. So the Fed is pushing cuts out more than anything else. Chair Powell emphasized that rates “won’t go back to pre-Covid levels.” No surprise there.

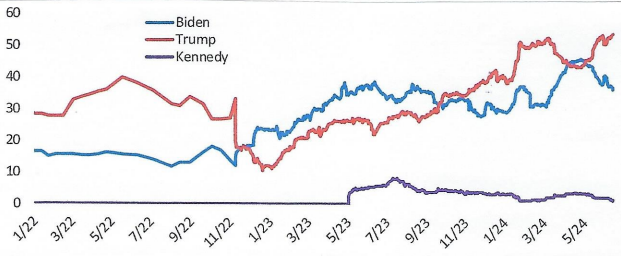

There are 140 days until Americans hit the polls. Using data from ElectionBettingOdds.com, former President Trump has seen his odds of a victory reach a new high of 54.1%, while incumbent President Biden’s odds have fallen to 36.5%. (The site aggregates and calculates the odds of a candidate being elected using a number of betting markets.) Please see the graph below which shows the betting odds for the presidential candidates since 2022:

2024 US PRESIDENTIAL ELECTION: ELECTION BETTING ODDS – SINCE 2022

Source: ElectionBettingOdds.com

The past results from this site are reasonably accurate but far from perfect (and subject to change this far out from the election). In 2016, the site had Hillary Clinton soundly beating Donald Trump.

BAD BREADTH

There is a significant amount of weakness going on underneath the surface of the S&P 500 and NASDAQ indexes. The divergence between mega-caps and the rest of the stock market seems to get more extreme with each passing day. Even though the S&P 500 is up this quarter and so far in June, the gains are coming from a small handful of stocks; most recently, Nvidia and Apple.

The S&P 500 index’s 13.8% gain through last Friday falls to +9% if Nvidia is removed and 5.5% if the Magnificent 7 were removed. Is this the sign of a healthy bull market? Not really. We always have concerns during a bull market, but this is one of our biggest.

The S&P 500 has edged up to the top of its uptrend channel and is now 4% above its 50-day moving average. That’s overbought by a considerable amount – and just because of a few stocks. It wouldn’t surprise us to see a short-term retracement in the S&P 500 and NASDAQ. How does the bull market continue? The rest of the market, the non-Magnificent 493, has to step it up.

Most investors, both retail and professional, have about 75% of their equity portfolio in non-tech stocks. There is frustration because most stocks in their portfolios are doing almost nothing this year. But there is plenty of hope. With interest rates likely to come down later this year and forecast record profits in the second half, non-tech stocks certainly have the potential to do better than they have so far.