Broad participation in the stock market is indicative of a healthy bull market. Currently all eleven sectors are comfortably above their 50-day moving average which is a sign of healthy breadth across the market spectrum. Also, even though every sector is above its 50-day moving average and the S&P 500 hit a record high yesterday, the only sector that also traded at a 52 week high was Real Estate, which accounts for less than 2.5% of the entire index. This is a reflection of the healthy rotation we continue to see where when one sector starts to lag, others are there to quickly pick up the slack.

It seems nearly certain that capital gains tax rates will soon rise. But despite conventional wisdom, that doesn’t mean equity valuations must fall. According to UBS Global Wealth Management, history shows no discernable correlation between equity valuations and changes to the capital gains tax rate. Earnings multiples on the S&P 500 can range anywhere from 8 to more than 20 whether capital gains are taxed at 15% or over 30%.

A TOUGH QUARTER FOR BONDS – WHAT TO DO NOW IN BOND PORTFOLIOS

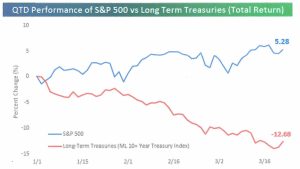

It was a bad quarter for Treasury bonds. Even with the relative safety of Treasuries (no default risk) investors got pounded as interest rates surged and bond prices plummeted. For the quarter, the 20+ year Treasury ETF (ticker: TLT) was down 14.1% (and 16.7% for the previous 12 months). This was the worse quarter for longer-dated Treasury securities in over 30 years. Compounding the weakness even more is the fact the S&P 500 was up over 5% in that same time span as shown in the following graph (data through March 22nd):

Source: Bespoke Investment Group

We use a simple strategy to avoid the ravages of sharply higher interest rates in bond portfolios. Our approach is to invest only in high quality (investment grade), short and intermediate-term maturities for both Treasury and corporate obligations. Sure, we are giving up some current yield, but we are focused on protecting principal for clients which is the main objective of owning bonds in the first place. When the odds are stacked against bond investors (as interest rates may rise further), we recommend investors stay with shorter-term bonds. Our philosophy is to take risks in stocks and make fixed income the most boring part of the portfolio.

Why did interest rates surge in the first quarter? Two main reasons: First, a supercharged economy is likely to emerge from the pandemic–induced recession. Second, investors fear soaring inflation (which hasn’t happened yet – it is only fear at this point). As we wrote in last month’s mid-month commentary, stocks do best when inflation remains under 5%, still a good bet today.

If interest rates keep rising, will the bull market in stocks be derailed? Not necessarily. BMO Capital Markets points out that during seven prolonged periods of rising rates since 1990, the S&P 500 climbed at an average annualized rate of 15.1%.