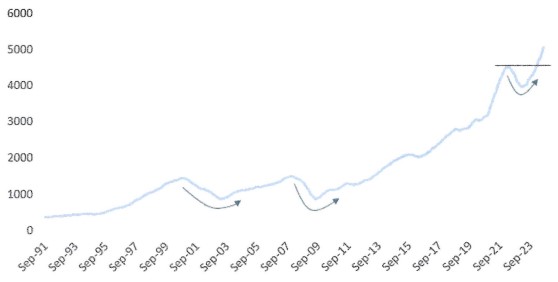

Stocks remain in an uptrend whether you look at short-term or long-term indicators. We will focus here on the longer-term, the 200-day moving average. As shown in the graph below, the S&P 500’s 200-day continues to make another leg higher and has yet to roll over:

S&P 500 200-DAY MOVING AVERAGE: 1991-PRESENT

Source: Bespoke Investment Group

It would take many months of weak market action for this 200-day trend to shift lower.

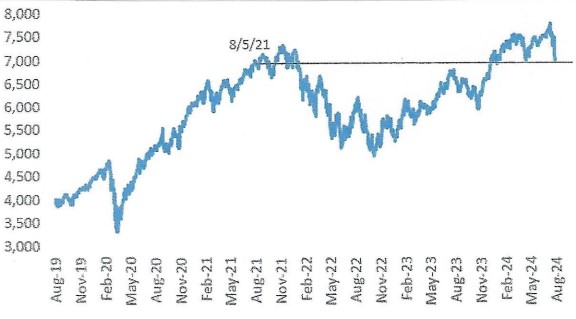

Even with the market weakness since the July peak in stock prices, bears say we remain in a bubble (especially in tech). But the NASDAQ 100 Equal Weight Index was exactly flat over the last three years as shown below:

NASDAQ 100 EQUAL WEIGHT INDEX: LAST 5 YEARS

Source: Bespoke Investment Group

While a few mega-cap tech names in NASDAQ got frothy, it is hard to say the market is in a bubble when the average stock in the index has gone nowhere over a three-year period.

Bullish investor sentiment has plunged since the market peaked last month. In fact, Investor Intelligence (financial newsletter writers) just saw its biggest two-week drop since the 1987 crash. And bearish sentiment saw its biggest one week spike since November 2022 (American Association of Individual Investors).

As a contrarian, we love to see weak-handed investors scatter when the market turns lower because it clears out excessive optimism and allows long-term investors to buy at better prices.

WE REMAIN IN THE SOFT LANDING CAMP

Is a recession looming? Not based on the Atlanta Fed’s GDPNow tracker which is forecasting 2.5% annualized growth for this quarter. While this outlook may be revised down given the weak non-farm payrolls released on August 2, it is still inconsistent with the sort of slowing growth that tends to precede a recession. Growth will need to slow very rapidly to get us to recession. There are reasons we expect it won’t:

– Market interest rates have already fallen by 100 basis points since May. Even though the Fed hasn’t eased yet, expected easing has started to work its way into market rates which supports economic activity.

– Mortgage rates have fallen over 100 basis points since the peak which should stimulate residential construction spending.

– The Federal budget deficit is running around 7% of GDP. Aggregate expenditures are a strong tailwind even if it doesn’t rule out a recession. What this means over the longer-term is a big question for investors.

– Job creation, while falling, is still reasonably strong. Labor income growth looks sustainable and consumer borrowing has been low. As long as consumer spending holds up, labor market concerns are largely noise.

We understand there are questions about consumer spending, but there are good reasons to believe that the fundamentals of the economy are strong as we recently saw from solid earnings reports this season. We will, however, be monitoring trends in consumer spending closely. Thursday’s Retail Sales print will tell us more.

Our bottom line: We remain in the soft-landing camp. A still-growing economy helps set the stage for higher corporate profits and stock prices.