The pandemic closed casino doors and opened up a much more addictive and accessible form of gambling: online day trading. It is the new drug of choice for generations Y and Z. With zero commissions and easy access to leverage, those young adults are at risk of trading their lives away. Robinhood opened three million new accounts in Q1 2020, twice as many new accounts opened at Schwab, TD Ameritrade, and eTrade combined. In the midst of the first GameStop frenzy, 600,000 people downloaded the Robinhood app on one day. Social media influencers and celebrities shout out stock recommendations without any real basis for their self-promoting pronouncements.

Many readers of this commentary are financial professionals. As trusted advisors, it is our responsibility to help protect the children and grandchildren of our clients. It is important to educate the younger generation about the fundamentals of investing, buying on margin, short selling, and what it means to be an informed and intelligent investor. Day traders in the late 90s learned these lessons the hard way. This time around let us hope younger adults can learn these lessons without incurring financial and personal damage.

The dip in stock prices in the latter part of February is mostly attributable to the sharp increase in interest rates in February. There are two primary reasons for the rate rise. First, rising inflation expectations have investors questioning whether the Fed will stay with their stated plan of no rate increases for the foreseeable future. Fed Chairman Powell reiterated last week the Fed will not increase short-term rates until the 10 million unemployed are back at work post-Covid. But investors are worried that inflation will spike in the interim and force the Fed to act sooner (see our mid-February commentary on inflation). Second, economic growth has been strong since April and has been accelerating (mostly manufacturing).

In addition to higher rates, the yield curve is getting steeper. In the last six months, the 2s10s yield curve has steepened by 80 basis points, which is the steepest this curve has been since December of 2016. Investors should not fear the sharp steepening of the curve. When the curve steepens by 75 basis points or more, forward stock returns are positive and better than average (source: Bespoke Investment Group).

BLAST OFF FOR THE U.S. ECONOMY

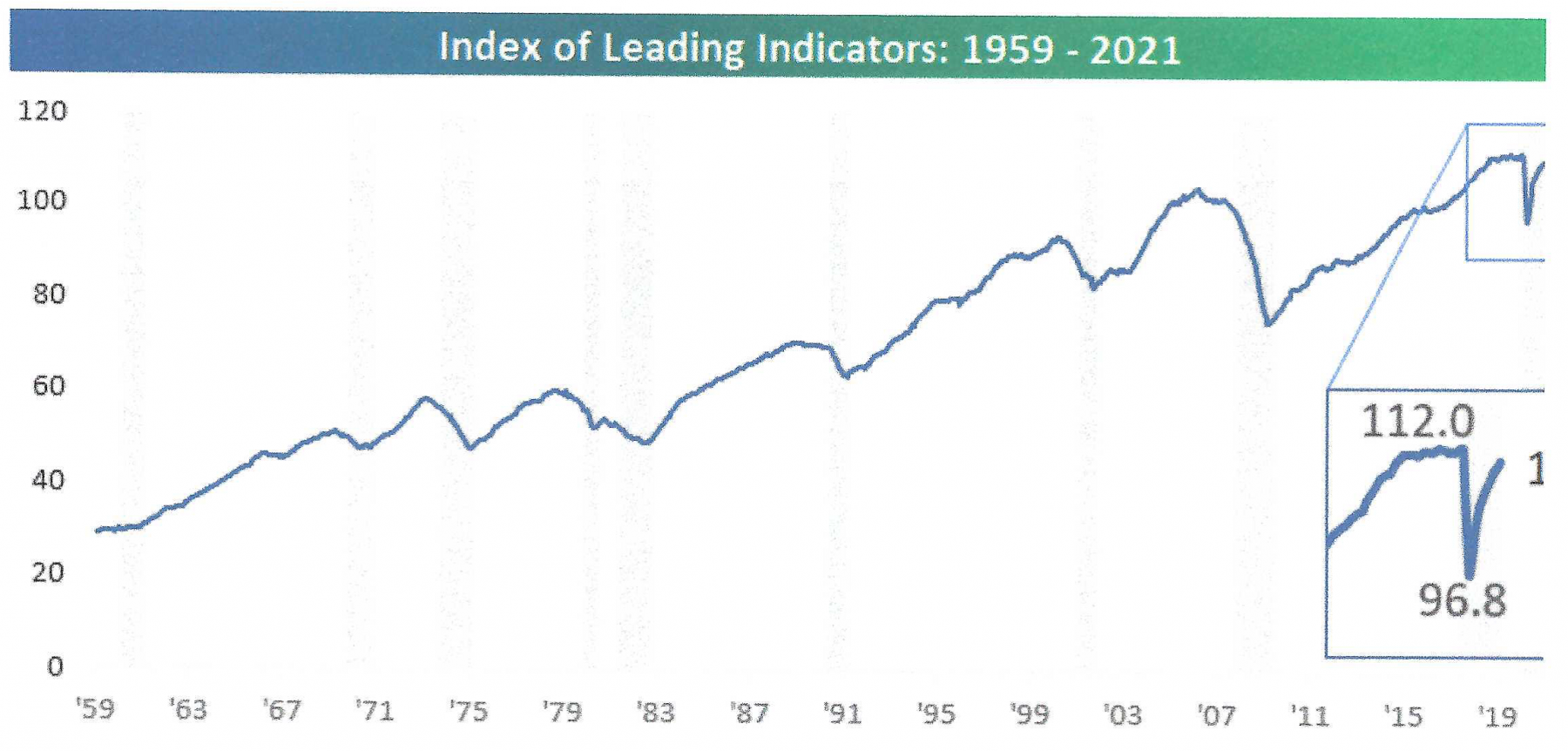

The U.S. economy continues to make great strides in recovering from the pandemic. The Index of Leading Indicators is just 1.5% below its peak from July 2019 and has erased nearly 90% of its decline. Since last April it has surged nearly 14%, which is just the second time since 1959 that the nine-month rate of change topped 10%. The graph below shows the quick snap-back in economic activity:

Source: Bespoke Investment Group

One key question about the recovery is how quickly employment will snap back in the wake of the pandemic-related recession. Most economists look for a much faster return to full employment than after the Great Recession. The economy did not reach full employment in the last cycle until 2017, 31 quarters into the recovery. This time Bank of America Global Research expects full employment by Q3 2022, nine quarters into the recovery.

The economic blast off from the April low supports our thesis we are in both a new economic cycle and market cycle. Although parts of the backdrop don’t look like a typical new bull market (for example, valuations are rich and sentiment is bullish), we think there is plenty of runway ahead for both our economy and stock market. We expect further robust gains in economic growth and corporate earnings.