Tariff Tantrum: Why China Can’t Afford a Trade War with the U.S.

The rate of earnings growth likely peaked in Q1 (+25%) with growth for all of 2018 forecast at 19.8%. The 2019 forecast will see a deceleration to a still healthy 10.0% (resulting from operating earnings, not the federal tax overhaul – Source: FactSet). In...

Show Us the Money

Although we were disappointed stock prices didn’t react to spectacular firstquarter earnings (+25%), we remain very interested in what corporations are doing with the extra cash and how this might eventually boost share prices. Share repurchases. First quarter...

Fear, Greed, and Valuations: An Update

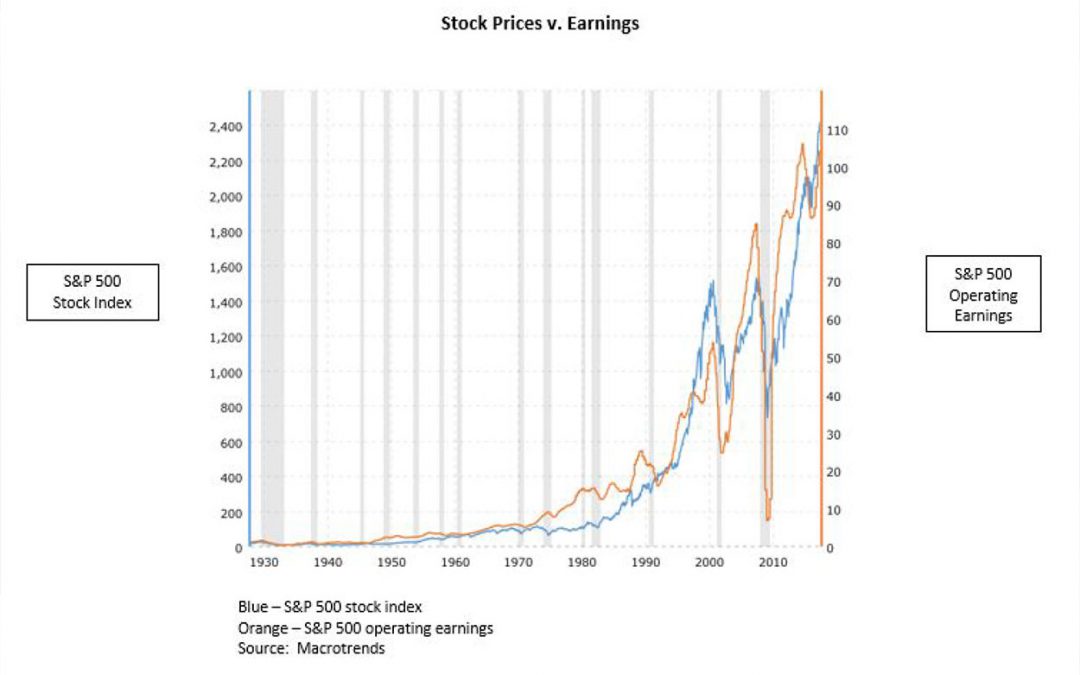

Earnings reports for Q1 have been nothing short of spectacular (helped by the recent reduction in corporate income tax rates). Reported earnings growth to date is 23.2% with revenue growth of 8.4% (source: FactSet). Net profit margins are 11.1%, a postfinancial...

Can FANG and Tech Recovery Heal the Stock Market?

Earnings season starts in earnest next week. Can the expected surge in earnings stabilize the market and provide a base for the next rally phase? The big question is whether the good earnings forecasts are already discounted in share prices. We won’t know that until...