- So far in 2020 we have had a pandemic, a recession, an impeachment trial of a president, social unrest, and a contentious presidential campaign. The coming year could be just as eventful. What do institutional money managers think about such an uncertain environment for investing? According to Barron’s recent Big Money poll, even with all this uncertainty, 54% say they are bullish, one-third neutral, and only 13% bearish. Yet 44% think stock prices are overvalued while only 6% think they are undervalued. Bullish sentiment prevails but with a sense of overvaluation. Some analysts are calling this combination “irrational exuberance,” a term made famous in 1996 by then Fed Chairman Alan Greenspan. However, not everyone is exuberant. Concerns about a stock market crash remain at record highs for individual investors and are now at multi-year highs for institutional investors (source: Yale’s monthly sentiment survey). And, according to Barron’s poll, the biggest risks to the stock market in the next 12 months are the pandemic (26% of respondents), the U.S. election (17%), and the U.S. recession (12%).

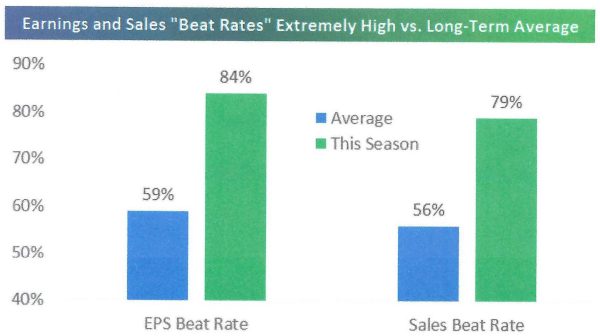

- It has been a good earnings season so far, but you would never know it based on stock price reactions. Both earnings and revenues have been exceeding analyst forecasts at a much better than average pace. Yet share price reactions have been disappointing. Even some companies reporting “triple plays” (both a revenue and earnings beat, and raised guidance) have seen their share prices decline after the positive announcement. Clearly investors are focused on other things. But the market always comes back to earnings so these good numbers will eventually come to the forefront and get investors’ attention. As shown below, both the earnings and sales “beat rates” this quarter are outstanding:

Source: Bespoke Investment Group

COVID-19 RESURGENCE

The Dow Jones Industrial Average is down 1800 points so far this week (about 6%). In our view, the main reason is the rapid rise in Covid statistics. Although the current number of cases per million population per day is much lower than prior peaks, new confirmed cases, hospitalization rates, and deaths are all increasing. It is not a positive trend. Investors are concerned about another lockdown across the country and what that would do to our strengthening but still wobbly economy. Pandemic sensitive stocks (including airlines, cruise lines, hotels, and casinos) have been getting crushed.

This is not a normal market environment. The economic picture is extremely uncertain. Jobless claims are at historic highs, yet retail sales are robust. Many Americans are afraid they may be evicted in the next few months, while at the same time, home sales are booming. Corporate earnings are down more than 30% from their peak, but stock prices are still near record highs. Although it is not uncommon to have mixed messages in the market, usually this type of uncertainty is met with discounted equity prices. That is not the case today. Today’s valuations are rich alongside a surge in the pandemic, no new stimulus package, next week’s election, and so on. Clearly there are major headwinds preventing this market from making any progress. The stock market needs a catalyst (for example, major progress on a vaccine) before it is likely to advance further. As long-term investors we remain fully invested. Our focus is always on analysis, not forecasting.