We sincerely appreciate our relationships with clients and friends and want to say thank you during this joyous season. May your holidays be bright. We wish you the best in 2022.

Pundits have been quick to point out that inflation could be a major roadblock to further gains in equities. However, in almost 100 years of market history, stocks have gained ground, on average, whether inflation is rising or falling.

Yes, stocks have performed better when inflation is moving lower, but they have performed admirably when inflation rates rise as well. Value stocks and dividend payers tend to do the best. Stocks have even performed well when inflation is over 6% like it is now (yr/yr). Supposed market experts may argue otherwise, but equities have long been a terrific hedge against inflation.

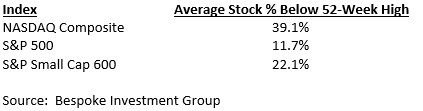

Anyone with a large portion of their equities invested in large caps like the S&P 500 has had a great year and may not know there is a lot of weakness under the surface. Most stocks have undergone a correction of at least 10% at some point this year. For many individual stocks the correction or bear market continues. This is especially true for the NASDAQ Composite index which is more of a tech-related “growth” index than the S&P 500. Here is how much the average stock in the index listed is below its 52-week high:

While this price weakness may be frustrating to some investors, it shows the potential for the market if these stocks advance back towards their 52-week highs. This year the market has been dominated by a handful of mega-caps but the snapback potential of most stocks could help drive the market higher.

THE EARNINGS BOOM

The boom in corporate earnings has been extraordinary over the last two quarters with this quarter’s forecast up 21.2% (source: FactSet). Bears point out that this is only a snapback surge and can’t continue as earnings have risen almost 60% off the pandemic low. They are right. Earnings will not continue to grow by quantum leaps once we get past 2021. But let’s instead look at earnings growth since the pre-pandemic peak to get a more accurate reading on just how strong earnings really are.

The graph below shows S&P 500 earnings going back five years, and that earnings for the next 12 months should be 24% higher than they were at the pre-Covid peak. And while growth has slowed, it is still moving higher.

Earnings Soared As Real Rates Fall…A Perfect Recipe For Equity Gains

Source: Bespoke Investment Group

The forecast for 2022 earnings growth is 9.0% (source: FactSet). This is very impressive growth on top of explosive growth this year. Earnings growth is one of the main themes that could move stocks higher in 2022.