During this holiday season, we want to take this opportunity to express our sincere appreciation and gratitude to all of our clients and friends. Our best wishes to you and your loved ones for a Merry Christmas and Happy Hanukkah!

Where is this year’s Santa Claus rally?… Yesterday morning’s favorable November CPI report (up 7.1% year-over-year) and today’s FOMC announcement will go a long way in determining the market tone to finish off what has been one of the weaker years in financial market history.

Investors can’t make up their mind over whether the economy is running too hot (November non-farm payrolls, ISM Services) or too cold (residential housing, ISM Manufacturing). Looking at the actual data, momentum has clearly been weak and getting weaker. Between that and an inverted yield curve, it looks as though the early December weakness in equities was more related to economic concerns than strength.

As we close the book on 2022, here are a few of our macro-economic observations about the U.S. economy and markets:

Economy

Momentum in economic growth is slowing but not collapsing.

Even though the U.S. economic foundation is fairly solid (consumer, corporate, jobs), the probability of a recession in 2023 has increased.

Inflation peaked in Q2 and will fall irregularly. One big reason for inflation expectations remaining contained is because commodity prices have been falling hard.

Earnings expectations remain too high for 2023 at +5%. Many leading economists expect lower corporate earnings next year, as do we.

Markets

Stock valuations have improved significantly but are still not cheap (see main section).

TINA (‘there is no alternative’) is no longer valid.

A true equity market bottom likely requires signs of capitulation we haven’t seen yet.

Fraudulent aspects of the crypto space are being exposed and shaken out.

Based on the action of the bond market, investors appear on board with the idea of weaker inflation and a weaker economy to go along with it. Treasuries have seen quite the bounce over the last month. The 20+ year Treasury bond ETF (TLT) has rallied 16.8% over the last month.

Trying to analyze the market is always a mixed bag. It seems to us not all the potential bad news has been discounted in share prices so there is still potential downside. The market tends to bottom at the peak in bad news. We do not think we are there yet.

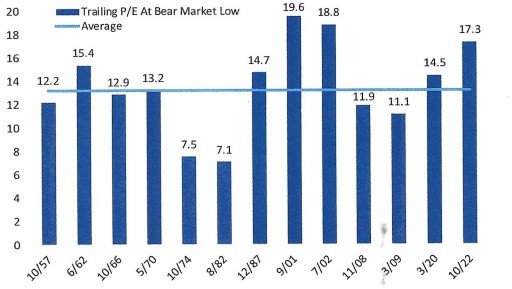

ARE P/Es LOW ENOUGH FOR A BEAR MARKET BOTTOM?

Source: Bespoke Investment Group

At 17.3x trailing earnings, there is more downside possible based on historical precedent, especially as 2023 earnings estimates are revised lower.

Although this bar chart is a bit sobering, keep in mind valuations are just one factor in the market’s future path and are not a good timing tool. And although the overall market may not yet be a bargain, many quality stocks are selling at bargain basement levels. Our search for new ideas will focus on those opportunities.