During this holiday season, we want to thank you for your friendship and trust in us. Our best wishes to you for a Merry Christmas and Happy Hanukkah!

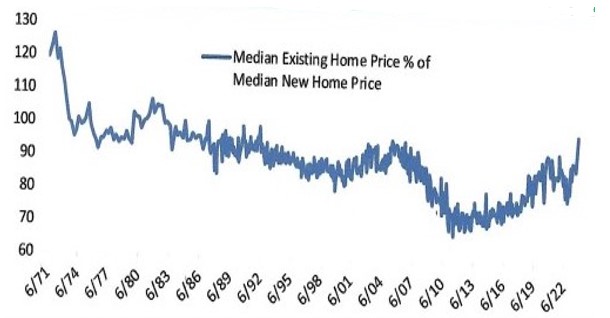

We follow the U.S. housing market closely because housing is such a significant part of our economy. The big problem for the housing market has been a dearth of inventory. The supply of existing homes has dried up. Potential sellers are not willing to buy a new home and be forced into a new high-rate mortgage. That supply shortage means existing homes are getting historically expensive versus new construction. The graph below shows they are the highest since 1992 in terms of relative median price.

Existing Homes Are Most Expensive vs New Since 1992

Source: Bespoke Investment Group

The good news is that demand for housing has cooled. Normalized rent growth will lead to lower rent inflation and help overall core inflation slow. We can also take heart in the drop mortgage rates have experienced since October. They have helped applications for home purchases pick up, although until refinancing applications start rising again, we know mortgage rates are still not stimulative.

GET INVESTED. STAY INVESTED.

We recently joked with clients that the stock market had a good year in November! November’s gains were both unexpected and large. The Dow Jones rose over 8% in November, the S&P 500 over 9%, and NASDAQ over 10%. After a dismal autumn, stocks did an about face and surprised many investors. It is another lesson why market timing doesn’t work. Long-term investors cannot afford to miss the good times if they want good long-term performance. It is best to get invested and stay invested.

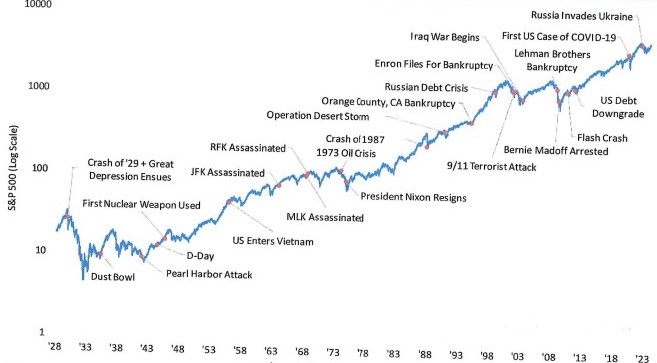

Below is a graph of the S&P 500 since 1928 along with key news events. Sure, the market struggles at times, but has always made new highs in spite of “bad news.” A wise investor once said: “Never bet on the end of the world, because it only happens once.”

S&P 500 Since 1928 (Log Scale)

Source: Bespoke Investment Group

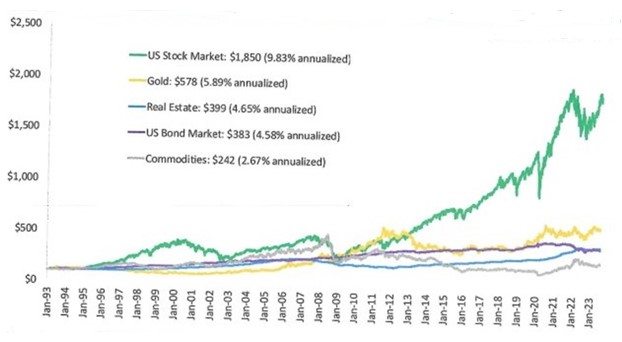

The next graph shows that stocks have been the top performer among different asset classes over the last 30 years by a wide margin. Bottom line: Never bet against stocks!

Growth of $100 in Various Asset Classes Over the Last 30 Years (1993-Present)

Source: Various

The strong performance in asset markets in November was not limited to stocks. Bonds also turned in a historic result with the strongest total return since May of 1985. The aggregate (multiple maturities) investment grade index was up 4.5% in November. Bonds across the global economy saw a huge drop in yields overall as every excuse for selling bonds from the summer was swapped for excuses to buy into year-end.

Of course the 60/40 portfolio had an amazing month. Contrary to some pundits thinking, the 60/40 portfolio is not dead.