One of the risks equity investors face is “headline risk.” Headline risk is being surprised (blindsided) by a bad news headline. It can be stock specific or relate to the entire market. Yesterday, investors got a dose of headline risk with news that a Chinese artificial-intelligence company was able to build a competitive model with inferior chips (compared to U.S. chips) at a price just a fraction of U.S. models; $6 million compared to a range in the U.S. of $100 million to $1 billion. The primary concerns are that this poses a threat to leading U.S. AI chip designers such as Nvidia and Broadcom, and that China is catching up to U.S. dominance in AI.

In our view it is too early to gauge the ramifications of the Chinese chips and models. But in typical Wall Street fashion, investors fired first and will aim later. If the U.S. data center builders want access to these less expensive China chips, China will want access to Nvidia’s more advanced chips now prohibited from being sold to Chinese firms. We highly doubt President Trump will agree to that.

After a stellar stock market for the first 11 months of 2024, stocks hit a wall in December and into January. It wasn’t a huge drawdown but it was enough to spook investors. Some market pundits said the AI theme was dead and maybe the bull market was over. Both stocks and bonds became very oversold and like a coiled spring, stocks surged beginning January 14th.

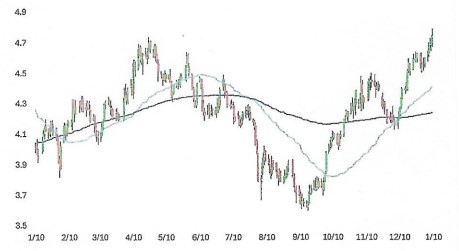

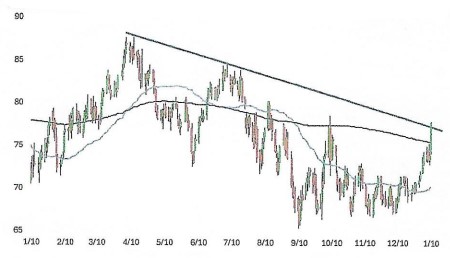

Why the December/January drawdown? It was the “three-headed monster” – a phrase coined by Bespoke Investment Group. The three heads are interest rates, oil prices, and the dollar. When these three economic variables are rising, short-term stock prices usually decline, and vice-versa. Look at the three graphs through mid-January – one for each variable.

10-YEAR TREASURY YIELD (%): LAST 12 MONTHS

WTI CRUDE OIL: LAST 12 MONTHS

US DOLLAR INDEX: LAST 12 MONTHS

Source: Bespoke Investment Group

All three graphs were rising as the three-headed monster reared its ugly head. However, since mid-January interest rates and oil prices have fallen and the dollar remains firm. The trend reversal is coincident with a rally in the stock market.

Of course this correlation is not perfect but it does makes sense: falling interest rates are typically good for stocks, lower oil prices lessen inflation pressure, and a falling dollar makes our exports more competitive. We will be watching closely to see if this model withstands the test of time. In the meantime, the bull market is back on track.

LONG-TERM BONDS ARE A LOUSY INVESTMENT

Bonds are meant to offer stability and income to balanced account investors. The types of bonds investors choose (including maturity length) are crucial to achieving these goals. Balanced account investors usually have a “laddered” bond portfolio. That is, a mix of short-term, intermediate-term and long-term maturities. Is this the best bond strategy? No. Why? Long-term bonds (10 year maturities and longer) have been a lousy investment for at least 20 years.

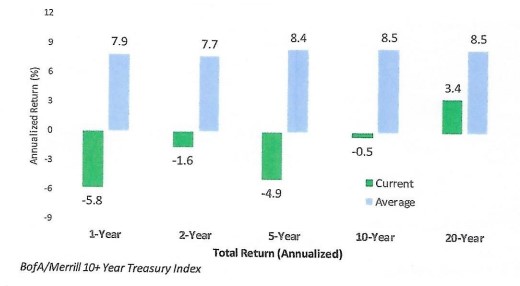

Take a look at the bar chart below. It shows annualized returns for long-term Treasuries are -5.8% for one year, -1.6% for two years, -4.9% for five years, -0.5% for 10 years, and +3.4% for 20 years.

LONG TERM TREASURIES VS AVERAGE TOTAL RETURNS: 1977-2025

Why are these returns so low, even negative? Two reasons: one, interest rates have been low for many years so the yield on bonds has been paltry, and second, rates have risen substantially in the last five years. When rates go up, bond prices decline. The longer the maturity, the more volatile the price as interest rates change.

Long maturity bond investors have been hurt as interest rates have risen. In fact, the last five, ten and twenty year holding periods have been the worst in the last 40+ years. If that is a safe haven asset, we will pass.

What is a better bond strategy for balanced account investors? Stick to only short-term bonds for two reasons. First, in a flat yield curve environment like now, the yield on short-term bonds is the same as long-term bonds. Second, short-term bond prices are much less sensitive to interest rates rising. Short-term bonds are more stable in price.

Some investors view owning only short-term bonds as too safe a strategy because the potential for capital gains (if interest rates fall) is much lower. That may be true, but look again at the historical returns of long-term bonds. We will pass. We would rather take portfolio risk in equities where the potential returns are greater (stocks have averaged 11% a year for 100 years). Stay with short-term bonds.