Going into yesterday’s Federal Reserve Board meeting, the futures market was pricing in an 85% chance that the Fed will cut rates by the end of July. This came without supportive or consistent commentary from Fed officials suggesting that rate cuts are imminent – until yesterday. Wednesday’s Fed decision keeps rates unchanged, but eight Fed board members indicated at least one rate cut later this year is likely. And the word “patience” was dropped compared to prior statements which had been tied to leaving rates unchanged. So the announcement didn’t provide any fireworks but leaves the Fed an opening for a July cut.

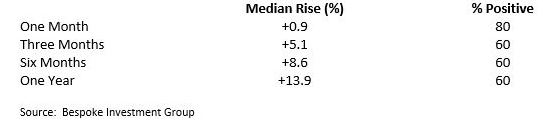

Usually, one rate cut is followed by more cuts. What can equity investors expect following the first rate cut of a new easing cycle?

Over the last 30 years …

Which market is correct? The bond market has a better predictive record, but we are siding with stock investors on this one. Economic data is not showing a recession on the horizon and corporate earnings growth this year has beaten expectations, with growth expected to return to double digits next year.