The S&P 500 may be only 5% below its all-time high (the NASDAQ, 10%), but the average stock is doing much worse. For example, the average stock in the Russell 3000 (a broader index than the S&P 500 that includes mid and small caps) is down 27% from its high, and nearly 40% of stocks in the NASDAQ composite are down 50% or more from their 52-week highs. The stocks of profitless and low profit-margin companies have been slammed – Goldman Sachs reports that the shares of high growth, low profit-margin stocks were trading at 16 times enterprise value-to-sales in February 2021. These stocks are now trading at seven times EV/S. We think investors’ focus this year will be on companies with strong balance sheets and good, consistent earnings growth. This has always been our focus as investors, so we like how we are positioned for 2022.

Stocks are cheap relative to bonds, but will that advantage remain as rates continue to rise? In other words, can stocks perform as the Fed commits to higher interest rates? History shows they can. Stocks have risen at an average annualized rate of 9% during the 12 Fed rate-hike cycles since the 1950s and showed positive returns in 11 of those instances. In a study of 15 periods when the rate on a 10-year Treasury rose by at least 1.5%, stocks averaged an annualized gain of 12% (source: Truist Advisory Services). Interest rates don’t always rise because of a negative event (like higher inflation). They can also rise due to strong economic growth which drives corporate profits higher. This rate rise is caused by a combination of both inflation and a strong economy.

Bonds are having the third worst start to a year going back 40 years. Only 2009 and 1982 were worse. The long-term Treasury’s price is down 5.3% in two weeks, a big drop for a ‘safe’ fixed income investment. Short-term Treasuries are down 0.5% by way of comparison. Long Treasuries don’t provide much more yield in spite of the increased interest rate risk, which can push down prices sharply as shown above. We would rather own more stocks than long bonds (including Treasuries). We will stay with our short-term bond strategy in an environment where the Fed will likely be raising rates starting in March.

WHEN WILL TECH STOCKS BOTTOM?

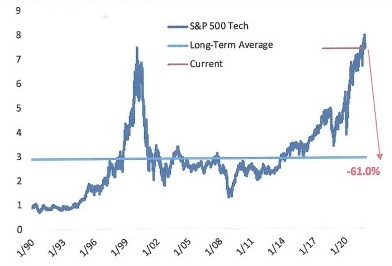

Technology stocks have led the recent market retreat since the S&P 500 peaked on December 27th. As we mentioned earlier in this commentary, low profit-margin and no-profit tech stocks are getting pummeled. The main reason for the drawdown is the recent sharp increase in interest rates which causes investors to re-price growth stocks. Growth stocks have much of their value in far-in-the-future cash flows which now gets discounted by a higher interest rate. Another reason is the valuations on S&P 500 tech stocks are extremely high. For example, the graph below shows that large cap tech has a higher price/sales ratio (P/S) than it did during the tech bubble:

MAJOR INDICES ARE TRADING AT SHOCKING PRICE-TO-SALES MULTIPLES

Source: Bespoke Investment Group

What if the P/S multiple were to retreat to the long-term average? Hypothetically, that would mean a 61% decline in the price of tech stocks: of course, there is no reason to assume that tech should mean – revert to the long-term average.

How can investors justify paying this multiple of sales for the tech sector? Does this mean tech stocks are only beginning their slide? Not necessarily. The best single justification for the increase in multiples for tech is its astounding profitability. For example, the S&P 500 tech sector has turned each dollar of revenue into 32.6 cents of EBITDA over the past year, a truly outstanding number compared to 22 cents at the tech bubble peak. This equates to profit margins being 50% higher than the ‘90s tech bubble as the graph shows:

MARGINS ARE 50% HIGHER THAN LAST TECH BUBBLE

Source: Bespoke Investment Group

Margins can’t grow forever, but with the top-line growing rapidly (about 15% year-over-year) with even steady margins, profits should continue to soar for the sector.

Tech stocks may not be great stocks in the short term, but many are great companies that can be picked up here cheaper than a couple months ago. For example, Microsoft is off 13% and Google is off 11% to name a few.

Although we are underweight tech’s big weighting in the S&P 500, we will not hesitate to pick up great tech companies at bargain prices if the price retreat continues. We will carefully balance growth and value stocks in portfolios with a barbell approach; value (including cyclical) stocks on one end combined with growth names (including tech) on the other end.