The S&P 500 has had a 20%+ return for two years in a row. It has only rallied 20%+ in back-to-back years three other times in history. Last year’s advance was mostly smooth without a 10% correction along the way. The ‘Mag 7’ now account for a third of the S&P 500’s market cap. The average Mag 7 stock returned 65% last year (skewed upward by Tesla and Nvidia). Growth stocks crushed value stocks again. It is no surprise why when you look at earnings growth: 19% for growth and minus 2% for value. High tech including the Mag 7 could lead the market higher again. The Mag 7, in particular, are both defensive (including fortress balance sheets) with substantial exposure to AI.

Is the market on stilts now? Not if you look at parts of the market outside large-cap tech. For example, small caps and dividend stocks are still at 2021 levels. Also, the equal-weighted S&P 500 has had a much slower rise than its cap-weighted We find all the bubble talk as an exaggeration.

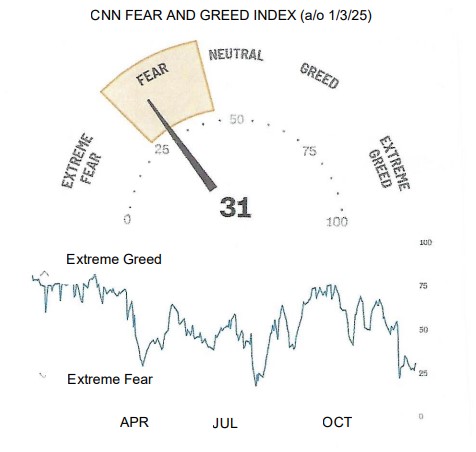

December, however, was no picnic. Market breadth was awful. As a result, sentiment plunged which is probably a good thing coming into 2025. The weekly survey from the American Association of Individual Investors (AAII) showed bullish sentiment pulled back to 25.4%, its lowest reading since last April. The CNN Fear and Greed Index recently moved into the ‘fear’ zone. We like it when investors get nervous and scatter at the first sign of weakness.

Source: CNN

Wall Street analysts are very bullish for 2025, expecting a 14% rise in the S&P 500 (based on analyst target prices for each component). We are bullish, too, but don’t pretend to be precise with projections. The odds are with us that the bull continues. Since 1928, the market trades in a bull market 80% of the time.

BUILDING BLOCKS FOR A PROFITABLE 2025

Market fundamentals remain strong. Let’s look at building blocks in place that point to potentially good markets in 2025:

- Strong Economy – Despite concerns over the health of the economy towards the end of last summer, it has rebounded and remained strong heading into the new year on both an absolute basis and relative to expectations. The NFIB’s Small Business Optimism gauge saw its biggest monthly jump since 1980 in November. The most cited reason was an improved political climate. There is no recession in sight.

- Corporate profits are expected to be up a whopping 15% this year after rising approximately 9.5% in 2024 (source: FactSet). This may seem heady until you realize profit margins are at a historical peak. President-Elect Trump’s plan to lower corporate taxes and cut regulation would be a tailwind to the 2025 forecast.

- The Fed is in easing mode but this is now an arguable point. The Fed surprised investors in December by announcing they might be looking at only two rate cuts this year, not the four cuts investors were expecting. Jobs are still posting gains and the overall economic momentum remains strong, so some ask what the compelling reason is there to keep cutting. Investors even go so far to call it a kind of ‘one and done’ cycle. We don’t agree, although we don’t expect the Fed to cut rates again in the early months of this year. The Fed’s policy is neutral at worst, still better than the harsh tightening cycle the Fed embarked on only a few years ago. We still view likely Fed policy as a plus.

- The U.S. could be on the cusp of a productivity boom similar to the one triggered by internet technology in the 1990s. Worker productivity is regarded by economists as one of the most important drivers of long-term economic performance. Quarterly productivity readings, although volatile, will be one of the most important indicators to watch in the years ahead. We will write more on productivity in a future commentary.

… We would not be responsible investors if we didn’t also mention market headwinds. After all, markets are a tug-of-war between good and bad news, between the bulls and bears.

- Will there be a revolt against the AI theme? At some point(s) in 2025, we expect investors to question whether AI is a commercial success allowing companies to monetize huge AI investments. This likely skepticism may result in market drawdowns from time to time.

- Will the bond vigilantes hijack the bond market and slow or prevent stocks from rising. After all, in the three and a half months since the FOMC’s rate cut on September 18th, the 10-year U.S. Treasury yield increased by about 80 basis points. The stock market responds better to falling or lower interest rates – unless there is a recession on the horizon.

- Fed policy mistakes. Will they cut rates too aggressively with sticky inflation? Will they raise rates and choke the economy? The Fed has done a good job but is certainly capable of making mistakes.

- What about possible Trump policy errors? How inflationary will tariffs and the immigration effects be? Trump’s plan to raise tariffs would increase the average tariff rate to 17.7%, the highest level enacted since 1934 during the Great Depression. Will this prevent the Fed from cutting rates further?

- Over-valuation. This is not a big concern to us although many investors are worried about perceived over-valuation of stocks. Yes, the S&P 500 is trading at 22x estimated (robust) ’25 earnings, but ex the Mag 7, the ratio drops to 18x, about in line with the five year and 10 year market averages. Mag 7 stocks have high P/E ratios but their earnings growth is well above average.

That’s a lot of information to digest. Where do we stand? We remain steadfastly bullish with expectations for a profitable but more modest 2025. We don’t really believe in pinpoint forecasting because no one can see the future. Instead, our investment strategy and stock selections are based on a time-tested investment discipline that has proven itself over many years.