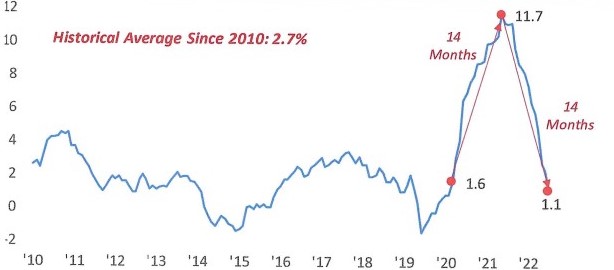

While the consumer price index (CPI) has fallen from 9% to 4% year-over-year, the producer price index (PPI) has been more volatile on both the upside and subsequent fall. (The CPI measures inflation to consumers or end-users. The PPI measures wholesale price inflation, or business-to-business.) The graph below shows it took 14 months for the PPI to rise from 1.6% to 11.7%, but the reading has fallen even more than it rose over the last 14 months.

PPI – FINAL DEMAND (Y/Y, % CHANGE)

Source: Bespoke Investment Group

Leading up to the peak in inflation last year, producer prices were rising even more quickly than consumer prices, which was a major headwind for business profits. Now we are seeing the opposite, where the PPI is routinely lower than the CPI, which means higher profit margins for businesses going forward.

This helps explain why earnings are expected to turn up later this year and into 2024. Next year’s 12% consensus profit growth estimate has upside potential. Any profits recession we may have had in 2023’s first two quarters appears to be over. This may be further stimulus for the bull market.

Investors accelerated their purchases of T-Bills when the 12-month Treasury yield first closed above 5% on February 22. After all, cash was no longer trash. It seemed like a good hide-out from an uncertain stock market to many. Since then investors have earned 1.7% on their T-Bills, but the stock market has gained 11%! It is a reminder that the stock market may be unpredictable, but cash is not a suitable alternative for long-term investors. You don’t get rich by rolling over T-Bills.

THE 2023 RECESSION IS MISSING IN ACTION

There is a lot of debate over whether the rally off the October lows qualifies as a ‘real’ bull market. How much will the S&P 500 index have to rally for the naysayers to acknowledge that stocks are indeed in a new bull market? 30%? 40%? The NASDAQ 100 is already up 40% off its lows. Is that not a bull market yet?

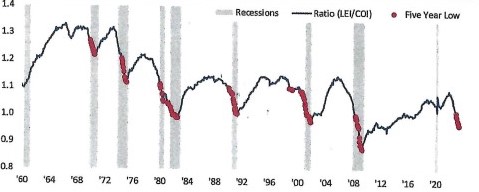

So where is the long anticipated recession? Economic data hasn’t been as bad as economists’ forecasts, but it still has been weak. Additionally, indicators like the Leading Indicators and the yield curve inversion are currently at levels which have been extremely reliable predictors of a looming recession in the past. If that is the case, why are stocks trading within a couple of percentage points off 52-week highs? Here’s one ominous indicator: the ratio of leading to coincident indicators. The graph goes back to 1960 and shows similar legs down, all leading to recession.

RATIO OF LEADING TO COINCIDENT INDICATORS: 1960-2023

Source: Bespoke Investment Group

Source: Bespoke Investment Group

Now, as we highlighted in our last commentary, technical factors signal additional gains in the S&P 500 in the months ahead. But if the economy is headed for a recession, why are stocks trending so positively. It seems like a pretty big disconnect, right?

Our explanation is that investors are betting on a soft landing with no recession. Is this really possible? Sure it is, but we still place 50/50 odds on having a recession. It is a coin flip. Is a recession, even a mild one, factored in stock prices? That is the $64,000 question.

If the market has it right, we are looking at expansion in both the economy and corporate profits above the current 2024 consensus earnings expectation of 12% growth. This would help justify current rich valuations. Under this scenario, we would also say the economy and jobs market turned out to be far less sensitive to interest rates than economists and the Fed thought, at least so far.

If the market has it wrong and we have a recession, it may be time for the first correction for the young bull market. Economic contraction will pressure earnings and highlight the rich valuation of the S&P 500 index. It may be hard for stocks to rally, especially cyclicals, until we see the green shoots of recovery.

Our view: A recession may pause the bull market but not derail it because:

– Investor sentiment is getting more bullish with plenty of room left to become even more bullish (increasing demand for stocks).

– A monumental $5.5 trillion in money market funds gives investors plenty of buying power.

– FOMO (fear of missing out). Since so many investors missed the rally since October, investors may now view any market weakness as ‘buy the dip.’