This week marks the beginning of earnings season for the second quarter. S&P 500 companies are expected to report a fourth straight quarter of growth, with profits forecast to rise 8.8% over last year’s second quarter (source: FactSet).

The top 10 companies in the S&P 500 make up about 37% of the index’s market cap. The growing size of the heavyweights means a lot is riding on their ability to deliver on profits and guidance. There is record-high bullishness on future earnings from a small group of companies. Is it justified? It certainly has been so far. These are fantastic companies in transformative industries. Earnings growth rates for these companies are much higher than for most other companies and justify the valuations, in our view. So buckle up and get ready for another earnings season.

Post-debate, former President Trump’s odds have gained 5 points versus the day before the debate (based on betting markets). Trump is now being given close to a 60% chance to win in November. The odds are high enough that there were “Trump trades” at work in the markets last week.

Meanwhile, President Biden’s odds shed a massive 15 points for the largest post-debate loss for any candidate in the past few elections. Other Democratic candidates are now preferred: namely current VP Kamala Harris and California Governor Gavin Newsome who now combined have the highest odds since September 2021. As for the markets, the debate was a non-event the day after.

SCORECARD: Q2 FUELED BY AI

The market drama in the second quarter of 2024 was all under the surface. The S&P 500 index rose 3.9% but the average stock fell 4.2% in the quarter. Only a third of the index members actually closed higher in Q2.

Artificial intelligence continues to be the fuel propelling stocks since the bull market began in late 2022, and the second quarter was no different. We concede some AI stocks look frothy, but the broader market does not. Valuation for the non-AI corner of the market remains below their March peak.

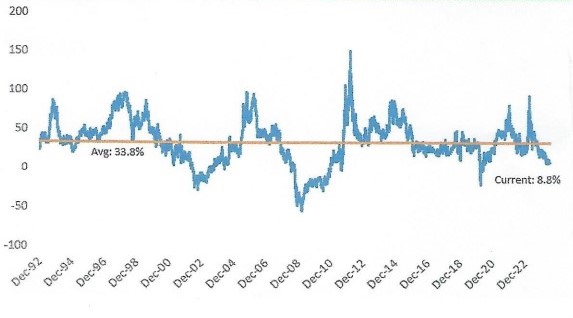

In addition, six out of 11 sectors in the S&P 500 lost market value last quarter. And while some mega-cap AI stocks look extended, the S&P 500 Equal Weight Index is up just 8.8% over the last three years, which is 25 percentage points below its historical average three-year change of 33.8%. Hardly an overheated market. See the graph below:

S&P 500 Equal Weight Index: Rolling 3-Year % Change

Source: Bespoke Investment Group

We have mentioned previously we would like to see a broader market advance to convince us this bull could last for a number of years more. Pessimists look for a sizeable near-term correction once the AI rally runs out of steam. But we offer a more cheerful interpretation: given the strength of our economy and corporate earnings, and the fact the broader market is cheaper than it was four months ago, we could be laying the groundwork for broader-based gains once interest rates finally come down. Imagine the dormant 75% of your portfolio starting to perk up.