In the week leading up to Memorial Day weekend, the S&P 500 traded higher 23 out of the prior 30 weeks. There have only been a handful of other periods since WWII where the index had as many positive weeks in a 30-week span.

Is the market exhausted after this run, or is this type of performance expected in a bull market? We think the latter. These types of streaks never marked a significant peak in the market. Statistically, one year later, returns were in line with historical norms and just as consistent to the upside.

There are good reasons for this market strength. Stabilizing, predictable inflation is preferable to changing, unpredictable inflation. And record high profits (expected in the second half of this year) are preferable to recessionary earnings.

Of course, there are warning signs out there – there always are. Even in the strongest bull markets there are reasons to worry. Hence, the old saying – “bull markets climb a wall of worry.” Here are some of today’s warning signs:

– Weakening breadth. Monthly sector leadership is constantly changing with no sectors consistently leading the bull market, including technology. The weak breadth picture has been evident within just about every sector, with few sectors having more than half of their components trading above their respective 50-day moving averages. This is a highly unusual divergence.

– Weakness in semiconductor stocks. For a sector that has typically been a leading indicator for the market and broader economy, the weakness in semis is a concern. The equal-weighted version of the main semi index failed to make a new high last month. Only a few semiconductor stocks rallied with Nvidia leading the group, up 27% in May.

– Commercial real estate. One of the biggest concerns cited by FOMC members about the economy is the commercial real estate market. The huge surge in commercial real estate prices during the pandemic period of low rates was reversed, falling 12% through the November 2023 lows. But prices have perked up once again over the past few months. Office building prices specifically have been hit much harder facing huge demand declines because of hybrid work.

– Our resilient economy slowed down in April. We comment more on this in the main section below.

These concerns are all valid but have not had a big impact on share prices. We are still trading just below all-time highs. The broader market may be stuck in traffic here, but we expect further gains in this ongoing bull market.

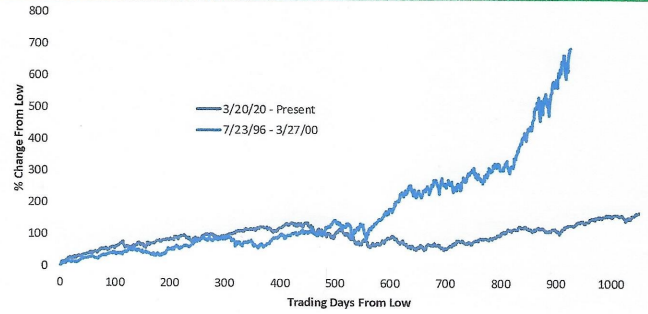

The AI boom and the enormous gain in Nvidia’s stock price have many bears proclaiming that history (the Dot.Com era) is repeating itself. Actually, the equity market (specifically, the NASDAQ 100 index which is very tech heavy) would have to post a much greater rally for things to look like they did back in the 1990s. See the graph below. The colors are hard to differentiate. The Dot.Com era graph is the one going parabolic. The current era graph shows a much more gradual rise:

NASDAQ 100 PERFORMANCE (%): 1996 LOW TO DOT.COM ERA HIGH

COVID CRASH TO PRESENT

Source: Bespoke Investment Group

Since the current tech bull market began March 30, 2020, the NASDAQ 100 has only risen around 170% since the COVID crash lows. Back in the 1990s, the NASDAQ 100 was up over 680% given the same amount of trading days. So there is a big difference in the amount of “speculation.” Our view is that the current tech rally is still fairly young. All of this shows that AI could still be in the early innings, as the NASDAQ 100 hasn’t gotten close to the upside action it saw in the 90s. Also, we still haven’t seen a wave of tech IPOs that would be expected. 1994 was the approximate start of the internet boom, so if AI continues to track a similar path, investors may be in store for some fun years ahead.

ARE WE HEADED TOWARDS STAGFLATION?

Regardless of what the experts say, there is no denying that Americans feel worried about inflation and a slowing economy, a wicked one-two punch that some say could result in stagflation. Are these worries justified? Are we headed down that path?

Let’s look at the economy first. Many economic indicators released for April showed slowing momentum. Manufacturing deteriorated in April along with the employment sector cooling. Housing has also shown weaker momentum and measures of the consumer turned south. What gives?

Actually, there are good reasons for the economy’s resilience in the aftermath of COVID, and many relate to the consumers’ persistent strength. Household wealth has increased meaningfully in the past several years across all income levels due to pandemic stimulus payments, wage growth, and the booming stock and housing markets. Unemployment remains low. All the hand-wringing about a slowdown in the labor market has been premature. People have a tendency to mistake normalization for weakness, when, in fact, the labor market remains quite strong.

We have had a robust economy in the past four quarters – real GDP has expanded by 2.9%. And the Q2 GDP forecast was raised from 3.3% to 4.2% by the Atlanta Fed’s GDPNow model. That is about twice the consensus forecast. While the forecast is not a guarantee, it would be hard to imagine GDP stagnating below 1% or even 2%.

Now, let’s turn to inflation. Yes, inflation has been sticky, hovering around 3% with seemingly minimal progress every month. But there is hope for the consumer. First, it is hard to lay blame on gas prices. The recent increase in gasoline is seasonal – the reality is that gas prices always go up this time of year. Second, there are coming price cuts for the consumer. We haven’t heard that in a while. Big-box retailers and fast-food restaurants have recently announced price rollbacks (including Walmart, Target, McDonald’s and Wendy’s). These price cuts will take time to make their way into official inflation statistics, but these kinds of headlines are music to the ears of Fed members. Don’t underestimate the impact these announcements can have on consumer inflation expectations, something the Fed looks at closely.

The last three years of inflation have had a material impact on the wallets and sentiment of all Americans. However, when we see solid economic growth forecasts combined with downward pressure on prices, we wonder what economists are looking at when they cry stagflation.