The main section in last month’s February commentary was titled “The Tech Bull Market Rolls On.” Tech stocks continue to lead the charge and exploded to the upside after NVIDIA reported stellar results last week. AI continues to be the driving theme in the stock market. In fact, since ChatGPT shocked the world with its product release on November 30, 2022, the 67 S&P 500 AI stocks have averaged a gain of 45%. The remaining 433 stocks in the index have only averaged a gain of 8% over the same time frame.

We continue to see new highs outnumber new lows in the S&P 500 on a daily basis. No surprise there. However, there are still less than 70% of stocks above their 50-day moving averages. This is just another way of showing that a small number of stocks are driving a lot of the S&P’s performance. It also means there is plenty of upside for a good chunk of stocks that haven’t been participating as much over the last months. When the market is rallying, we would prefer to see more stocks participating so that should some stocks start to tumble, there are still a lot of others to carry the load.

Many bulls remain optimistic because the current rally appears to be driven by strong earnings reports, rather than expectations for interest rate cuts. (The second half of earnings season was much stronger than the first half – again, led by tech companies.) The market still believes rate cuts are coming. As long as that is a question of “when” and not “if”, AI euphoria can keep lifting markets. Will AI mania affect the Fed’s behavior regarding rate cuts? Yes, we think it will. Don’t be surprised if looser financial conditions end up pushing the Fed into a later first rate cut than would otherwise be the case.

Comparisons are being made between the current technology boom and the one we had in the 1990s, led by the introduction of the internet and computers. Is 2024 closer to 1995 or 1999? 1995 was the beginning of the next leg higher, whereas 1999 was the peak of the bull market. Of course bulls believe this is 1995 all over again meaning there are more years for the current bull to run. We agree.

THERE IS NO PLACE LIKE HOME

We have always been a U.S.-centric equity investor but there are times when we make investments in foreign companies (using ADRs). Not so much lately, though. Our last foray with any meaningful foreign exposure was 2007, the year before the Financial Crisis. Since then the U.S. has trounced international markets with far superior returns. Our decision to focus on the U.S. since 2007 has been well rewarded.

Right now the rallying cry among many global investors is to sell the U.S. and buy Europe. Why? Valuations are much cheaper overseas. Well, they should be. The U.S. market should always trade at a premium given our global economic dominance and transparent markets. The gap in valuations has a lot to do with what kind of companies trade on each exchange and the composition of the various indexes. The S&P 500 is growth-stock heavy, with 37% of its market cap in the tech sector. Most of the European indexes have much less tech and more cyclical exposure – even when some of these countries (for example, England and Japan) are in recession. It is a setup that argues for continued supremacy by U.S. stocks over developed market peers.

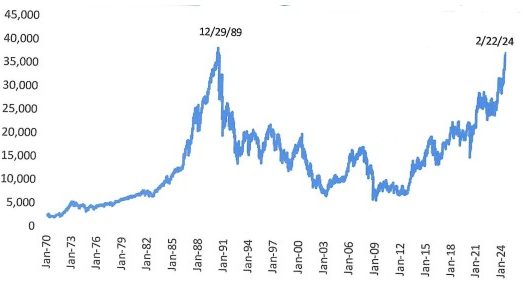

And then there is Japan. Japan’s Nikkei 225 index finally hit an all-time high recently (in spite of being in a recession). It took 34.2 years to do so, the longest streak without a new high in history. The U.S. streak of 25 years without a new high following the Great Depression ranks third on the list. During Japan’s 34 years of frustration, the S&P 500 rose about 1400%. Here is a graph of Japan’s NIKKEI 225 going back to 1970 showing the old and new all-time highs:

Japan’s Nikkei 225 Makes New All-Time High 1st Time in 34 Years

Source: Bespoke Investment Group

It is responsible as an investor to consider all opportunities, including those overseas. But we happen to live in the country with the best markets ever. Sometimes it’s smart to be a homebody.