Pavilion Global Markets recently did a study on the source of stock market returns over the last decade. According to Pavilion, the decomposition of returns for the S&P 500 breaks down as follows:

31.4% from earnings

7.1% from dividends

21.0% from multiple expansion

40.5% from share buybacks

Bears take the position that the large number of share buybacks account for the market being overvalued, and this demand may not be sustainable as earnings growth returns to more normal levels. Our position is that buybacks will continue due to their positive impact on share prices. When stock is bought back, earnings per share rise. With so much of executive compensation today based on stock awards, companies have every incentive to continue buybacks. There are no signs buybacks are slowing down.

With the CPI hitting the highest levels in decades on a year/year basis, the prospects of “transitory” inflation are dimming as economists and investors start to confront the prospects of a more persistent increase in prices. We think the following table is interesting; it shows various prices and stats now versus pre-Covid.

|

|

Pre-Covid |

October 2021 |

|

Gas |

$2.61 |

$3.40 |

|

Milk |

$3.37 |

$3.69 |

|

Chicken Breast |

$2.95 |

$3.59 |

|

Hourly Earnings |

$28.24 |

$30.96 |

|

Unemployed |

15,057,000 |

17,820,000 |

|

Corporate Profits |

$2.09 trillion |

$2.44 trillion |

|

Housing Prices |

$271,100 |

$352,800 |

|

Average Mortgage Rate |

3.69% |

3.07% |

Source: Bespoke Investment Group

Most prices/stats have risen significantly since pre-Covid. When will inflation cool? When will supply disruptions end? When will the employment market get back to equilibrium? All good questions for investors as they navigate today’s markets. Very interesting times.

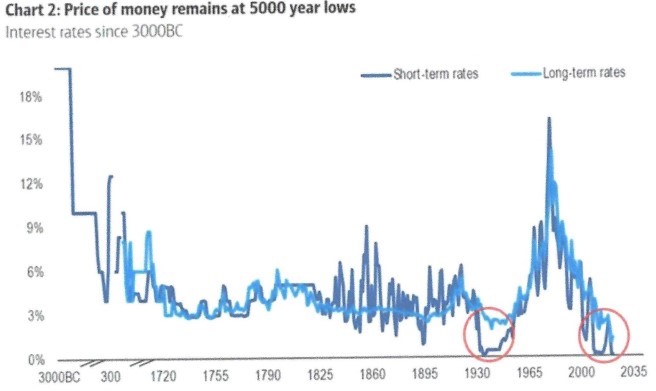

INTEREST RATES AT 5,000 YEAR LOWS

Given the Fed’s balance sheet is now an astonishing $8.5 trillion and the U.S. debt has ballooned to over $28 trillion, it is fortunate that interest rates are at a 5,000 year low. (See the graph below.) The Fed and the U.S. are in a tough spot. We need a lot of growth to dig out from mountains of debt. The U.S. cannot afford for rates to move too high or debt service will become an issue.

Source: BofA Global Investment Strategy, Bank of England, Global Financial Data, Homer and Sylla “A History of Interest Rates” (2005)

We applaud market historians who were able to trace interest rate levels going back thousands of years. The graph shows elevated levels in the 1980s are about the highest in global history. Notice the plunge in rates from the early 1980s. This resulted in the biggest bull market in bonds in U.S. history which many analysts say has come to an end. Many investors say rates must rise because they are so low. Or that continued shifts from bonds to stocks will cause rates to rise.

Rather, today’s ultra-low rates are indicative of the economic challenges we face. Low rates are emblematic of weak economic growth, deflationary pressures (mostly from technology), and demographic trends. These factors will likely put a cap on any rate rise even as many analysts expect sharp increases in rates – especially with current inflation. They point to these factors spooking the bond market:

- Debt ceiling battle: low risk (our assessment)

- Supply chain disruptions: medium risk

- Wage spiral: medium risk

- General inflation: high risk

- President Biden’s Build Back Better spending plans: high risk

Due to a massive increase in debt and leverage levels over the last 50 years, a rise in bond yields and a slowing economy are linked. The Fed should be motivated to keep rates low for this reason, and also to keep servicing costs on the Federal debt low as we mentioned earlier.

We remain in the camp that rates will only rise modestly in the next few years – despite today’s bounce-back economy, and inflation. We will continue to hold short-term (under five years), high-quality bonds. The yield curve is almost flat so investors are not being paid to buy longer-dated maturities which come with more interest rate risk. And retirement accounts should not hold low-quality paper in our view.

There is still a place for low-yielding bonds in balanced accounts as an effective diversification tool. A small amount of income is generated plus bonds provide ballast during stock market volatility. Balanced account investors love their bonds when stock prices dip.