CNN Business runs a “Fear and Greed” index which currently leans more towards “fear” than “greed.” The reading is generated by seven indicators including price momentum, put/call spreads, junk bond demand, market breadth, and market volatility. The current reading suggests investors are not complacent.

The weekly AAII sentiment survey also shows investors are subdued. While there have been a few bullish readings over 50% this year, recent bullish sentiment has dropped to only 38.9%.

One of our concerns about stocks earlier this year was excessive optimism bordering on euphoria. This no longer seems to be the case. Since sentiment is a contrary indicator, lower levels of bullishness are a positive for stocks.

Real estate prices remain elevated. Home prices have now risen above levels seen at the peak of the mid-2000s housing bubble in nearly every major city except Chicago (which is only 1% away from a new high). The three biggest price gains from prior bubble highs are Denver +98%, Dallas +90%, and Seattle +77%. Homeowners basically anywhere in the country that may have bought at the peak prior to the Financial Crisis have now seen their homes fully recover. This has to have a big impact on consumer sentiment.

CAN STOCKS CONTINUE TO ADVANCE WITH RISING INFLATION?

We have written about inflation a few times this year because inflation is one of the biggest risks to stocks in our view. On Tuesday the CPI was reported at 0.3% month-over-month versus 0.4% expected. Ex-food and energy (core inflation) rose 0.1% month-over-month. The headline CPI reading is up 5.3% year-over-year (with core inflation up 4.0%).

The Federal Reserve continues to believe that current year-over-year inflation over 5% is transitory. Part of their explanation is that we are coming off a low Covid “base” due to the 2020 recession. According to the Fed, price gains in the next 12 months are not expected to rise at the same pace. What if they are wrong and inflation remains persistent? Can equities produce further gains in an inflationary environment?

Goldman Sachs looked at equity returns during different inflation scenarios going back to 1962. Goldman cited what is important is not only the absolute level of inflation as measured by the Consumer Price Index but the trend higher or lower (“high” and “low” are defined by the CPI’s movement in comparison to forecasters’ projections).

In short, the study found that when inflation was high, stocks had a median market return of 9% annually, and when it was low, stocks gained 15%. Now let’s add the trend:

| Low inflation and rising | 4% annually |

| Low inflation and falling | 19% |

| High inflation and rising | 2% |

| High inflation and falling | 15% |

These historical statistics show that rising inflation hurts returns, so whether current inflation is transitory is likely to make a big difference in forward returns. We tend to side with the Fed that inflation may be transitory, but admit there is little visibility due to proposed massive fiscal stimulus, ongoing monetary stimulus, and Covid-related economic developments. Low interest rates indicate the bond market thinks inflation is transitory too.

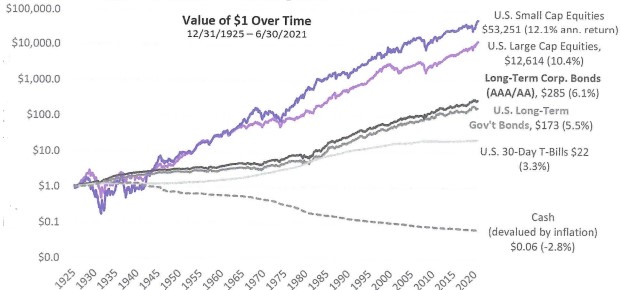

Looking at different asset classes, equities have offered better protection against inflation than bonds since 1926. The graph below shows small caps have offered the best protection followed by large caps. Note that cash gets devalued by inflation about 2.8% per year:

Source: Morningstar