At the end of June, the six month performance spread between the cap-weighted S&P 500 and equal-weighted S&P 500 was the highest in over 20 years, going back to March 2000. If an investor didn’t have heavy exposure to the Mag-7, their portfolio went nowhere on a YTD basis through June. This extreme lopsidedness reversed in Q3. Now, less than three months later, this YTD performance gap is almost back to zero.

The reason the S&P 500 equal-weight index has made a comeback versus the cap-weighted index is because the mega-caps have finally taken a breather while the rest of the market has done quite well. This is the market broadening out that the bulls were hoping for.

The Fed is expected to announce the start of the easing cycle tomorrow after the FOMC’s two day meeting. There is a tremendous amount of debate about whether it will be a 25 bp or 50 bp cut. Does it really matter? Not in our view. What is important is that the Fed is finally easing and will likely do so for an extended period of time. Our expectation continues to be for a soft landing so we do not think the Fed is behind the curve. Market interest rates have already started to move lower in anticipation of this Fed policy change. For example, mortgage rates are over 1% lower since their peak providing some spark to housing demand.

Lower interest rates should continue to be an important pillar to this ongoing bull market.

Until last week, we were getting concerned about the lackluster performance of semiconductor stocks. Our readers know that we view semis as a leading indicator of the overall market. In the week of September 2, the Philadelphia Semiconductor Index (SOX) was down 12%. That is quite a move down in a one week period. However, last week the tech trade, including semis, was back in a big way. Two leading semiconductor stocks, Nvidia and Broadcom, were up 15% and 22%, respectively. We view the AI theme as long-term and is nowhere near over. We continue to add to AI stocks, including semis.

COMPARING THE BIRTH OF THE INTERNET TO ARTIFICIAL INTELLIGENCE

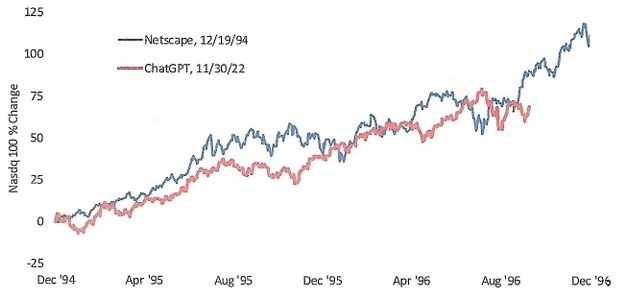

Let’s compare the beginning of the internet age (we will use Netscape as a marker, December 1994) with the beginning of the AI investment theme (ChatGPT, November 2022). The NASDAQ 100 performance for the first two years of each release tracks closely as seen in this graph:

Nasdaq 100 %Change in the 2 Years After Netscape Release vs. ChatGPT Release

Source: Bespoke Investment Group

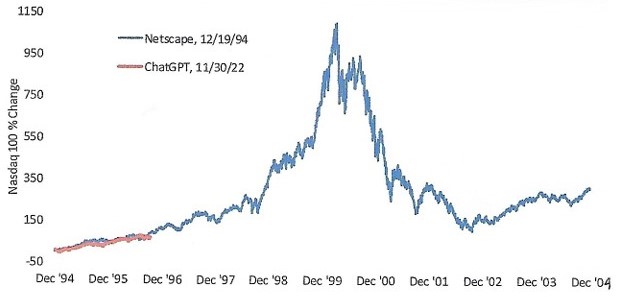

Now let’s look at the NASDAQ 100 percentage change for 10 years since the Netscape release. The graph goes parabolic until the dot.com bubble bursts in 1999:

Nasdaq 100 %Change in the 10 Years After Netscape Release vs. ChatGPT Release

Source: Bespoke Investment Group

Here is the $64,000 question: Can the current AI theme propel the NASDAQ 100 to dizzying heights in the next three years or so, similar to the late 1990s? It could in our view. The AI investment theme is still young and gaining momentum. Corporate investments in AI are accelerating with no sign of a slowdown. Just ask Nvidia. Closer to the end of the cycle, we would expect a surge in AI IPOs, but there are few to be found now.

This possibility leads us to continue with a heavy weighting in tech stocks, including those directly tied to AI. AI is the most dynamic tech release since the birth of the internet and we want to fully participate.