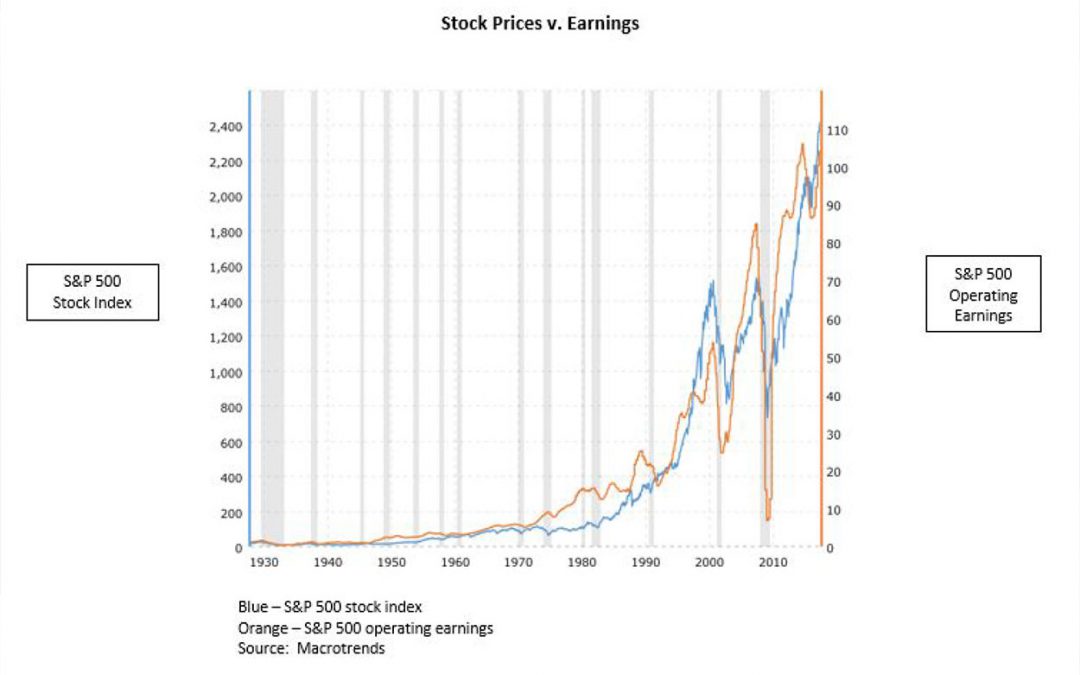

Although we were disappointed stock prices didn’t react to spectacular firstquarter earnings (+25%), we remain very interested in what corporations are doing with the extra cash and how this might eventually boost share prices.

Share repurchases. First quarter buybacks alone set a record of $178 billion (beating the previous mark of $172 billion in 2007’s third quarter). Often referred to as ‘financial engineering,’ lower share counts result in higher earnings per share for remaining shares. Since corporations tend to buy high and shy away at the lows, the current frenzied activity may be a sign that share prices are rich.

Dividend increases. In the first quarter, 187 S&P 500 companies increased their dividends, and no company cut their dividend (a first in over 15 years). Counting both dividends and share repurchases, the 12month total return of cash to shareholders was about $1 trillion! Many bulls cite this number (which equates to a 1.9% dividend yield plus a 3% yield on share repurchases) as one reason for their optimism.

Business investment. First quarter capital expenditures rose 21% over the prior year to an alltime high. Companies are both expanding for the future and investing in technology to make operations more efficient and profitable.

Bonuses and raises. Although many companies rewarded their employees with raises and onetime bonuses, the dollars pale in comparison to share buybacks and capex. Continued heavy buybacks, larger dividend increases, and robust business investment are largely the result of the corporate tax cut which shouldn’t be underestimated by investors. Buybacks accelerate a company’s growth in earnings per share, sharp, outsized dividend increases can help ‘push’ the stock price higher, and healthy business investment expands capacity to prepare for greater demand in a growing economy.

Bond Market Contagion Causes “Risk‑Off”

Assuming the Federal Reserve raises rates once again in June as we now expect, they will have pushed up short rates (Fed funds) by 1.75% since the recent tightening phase began. The results of this rate policy “normalization” have been fairly benign to this point but we are beginning to see change in the markets. Most prominently, rising rates have caused significant losses in intermediate and longer maturity bond investments as we described in last month’s commentary. An unanticipated flight to higher quality assets (about a 2.7% price gain on the 10year Treasury) at month end has temporarily reversed the trend.

Another more disturbing impact has surfaced recently as well. A much stronger dollar, beginning in midApril, has caused emerging market debt to decline in value. Many of the more challenged currencies, including the Turkish Lira, Argentine Peso, and Venezuelan Bolivar, have also seen huge declines and the contagion is spreading. Other countries, dependent upon the dollar to finance trade deficits, are experiencing both bond price and currency deterioration. As the dollar appreciates, it becomes incrementally harder for these borrowers to repay their debts.

Riskoff, or moving away from higher risk assets, now appears to be the consensus. Italy’s recently elected populist government is also perceived as a very real threat to the longterm viability of its own debt and the EU. Investors are waking up to the risks. Emerging market debt liquidity is poor in the best of times; it may soon be nonexistent. Further complicating the situation, many retail investors have no idea what securities are included in their bond funds and ETFs. Continued losses will no doubt illuminate the situation.

Neither emerging markets nor Italy are currently in crisis. However, concern has now shifted from return on principal to return of principal. We don’t purchase bonds or funds holding emerging market debt or noninvestment grade “junk” debt in client portfolios.