During this holiday season, we want to take this opportunity to express our sincere appreciation to all of our clients and friends. We cherish every relationship and are thinking of you with gratitude. We wish you and your loved ones a very Merry Christmas and Happy Hanukkah!

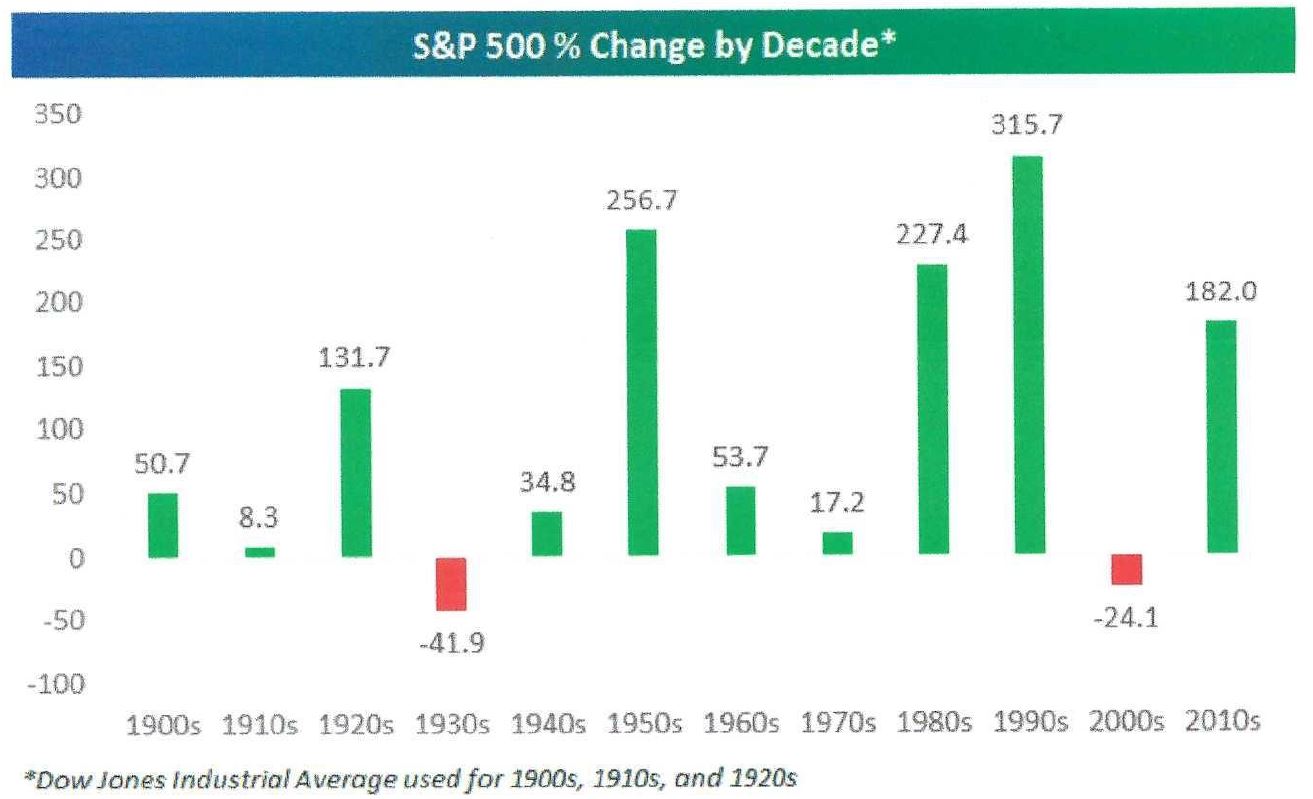

- With just two weeks left in the 2010s, here is how this decade stacks up over the last 100 years. With a price change of about 180%, the S&P 500 has had an excellent ten-year run. The 24% decline in the 2000s had two 50%+ bear markets which is why we have yet to see investor sentiment fully recover. As we enter the 2020s, we would rate investor sentiment neutral at best. Usually you see excessive bullishness after a run like this, but that has yet to materialize. When it does, it may signal a top.

Source: Bespoke Investment Group

- The global economic slowdown may be coming to an end as more global indicators are showing signs of life. But we expect only a modest recovery (not a V or U shape) because growth is being weighed down by aging demographic trends and too much debt. The slower recovery is due to people having too much stuff. Both young adults and seniors are becoming minimalists and are buying less. So there is too much manufacturing capacity relative to the slowing demand. We see this as the reason for the near-recession in manufacturing, not the trade wars.

- Investors should be happy with the trade deal with China announced last Friday. Critics were quick to slam the “phase one” pact, but it is basically a détente that eliminates the damage from pending U.S. tariffs and makes some progress on China’s intellectual property theft. The major U.S. concession is canceling penalty tariffs while for China, the most significant concessions include its predatory trade practices and new protections again patent theft. All of the agreements are merely promises for now and China routinely cheats, but now there is a dispute resolution process in place. President Trump will stand back and test if China will honor these new commitments. If successful, this agreement could lead to a quick “phase two” and be a big win for investors in 2020.

Stocks Having Best Year Since 2013

The S&P 500 is having its best run in six years, but individual investors are fleeing stock funds at the fastest pace in decades. Investors have pulled $135.5 billion from stock funds and ETFs so far this year, the biggest withdrawal on record (data goes back to 1992 – source: Refinitiv Lipper). Concerns center around the U.S.-China trade war and lingering recession worries. The outflows are a sign that investors aren’t chasing this year’s strong performance, suggesting major indexes still have plenty of room to run.

The retail selling of stock funds shows that individual investors are less bullish. The AAII sentiment survey shows that 36% of investors are bullish (8-week moving average) compared to 27% in July, but down from 50% in January 2018.

Where are the sales proceeds going? Bonds and money market funds. Individual investors have put roughly $277 billion into bond funds this year and another $482 billion into money market funds, an 11 year high. These enormous sums represent future buying power of stocks at some point.

So who is buying stocks and pushing prices sharply higher? Corporations. Companies themselves have been the biggest buyers of stock through share repurchases in recent years. Net stock purchases (after compensation to employees) of U.S. stocks are expected to total $480 billion this year, according to Goldman Sachs. Another $470 billion of purchases is expected next year, again according to Goldman.