- Investors are entering third-quarter earnings season with bright expectations that this could propel the next leg of the stock market’s rally. After all, analysts have been lifting estimates for the quarter – a move that goes against the norm. Typically, earnings expectations decline as the quarter progresses. This means analysts are probably closer to the mark than usual, so investors who expect big upside surprises could be disappointed. Investors will also be eager to know the outlook for the just-started fourth quarter. Given that some big companies have been throwing up caution flags in the form of layoffs (Disney, Dow, and Allstate), companies might understandably strike a cautious tone which investors should be ready for. It is unlikely, in our view, this earnings season will be a catalyst for higher share prices, especially with so many key macro events unfolding over the next few months (see main section below).

- Many smart investors think that the semiconductor industry may now be the most important sector of the stock market because of its informational value. So it was good to see the Philadelphia Semiconductor Index break out to a new high last Friday. Recent semi sales have been particularly strong for autos and mobile phones. Remember when semis were just found in computers and smartphones? Now they are everywhere. If semi manufacturers are doing well, so is the economy.

- Who the President is and what they do is very important, but maybe not as consequential as many would have you believe. For example, Presidents Trump and Obama could not be more different from each other, but their stock market performance results are quite similar. The two best performing sectors under both presidents were consumer discretionary and technology stocks. The worst performer under each? Energy. It is not just those three sectors. In fact, there has been a strong correlation between the performance ranks of all sectors with the exception of consumer staples. The business climate and earnings generation is what is most important to investors.

THE BULL AND BEAR CASE FOR STOCKS

There are always competing forces for investors to deal with. After all, that is what makes markets. Today’s balance sheet of pros and cons suggests headwinds as we enter Q4. Here are the factors we see as most significant:

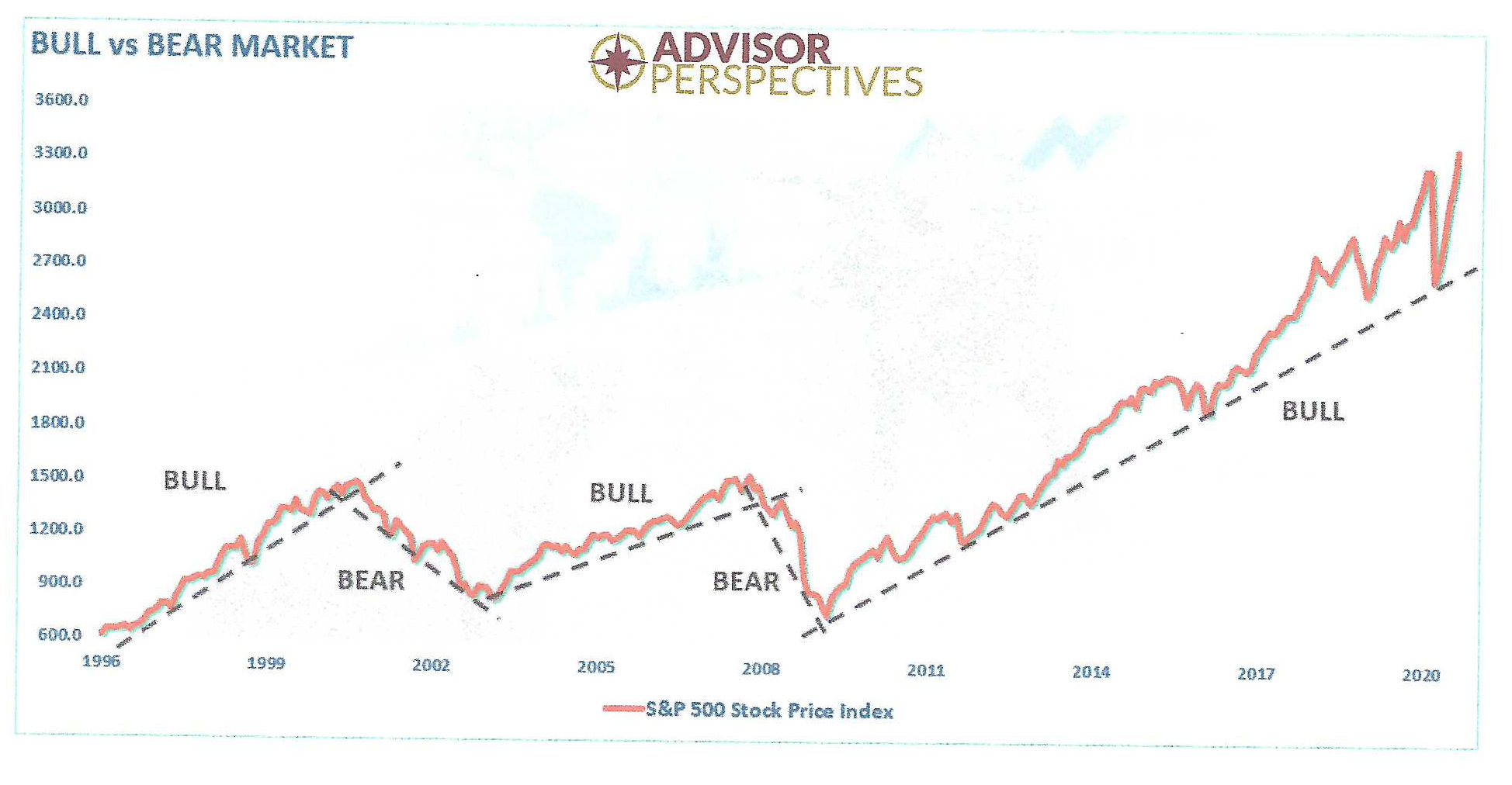

PROS

- We are still in a bull market. The following chart shows that the plunge earlier this year didn’t violate the long-term bullish trend (since 2009). This conclusion is based on the premise that bear markets are long-term affairs grinding sideways or lower over several months. The crash earlier this year only lasted about a month.

- The FED is massively accommodative. Don’t fight the Fed.

- Stocks remain cheap relative to bonds.

- Strong semiconductor industry and transportation sector.

- U.S. consumer is spending money.

- Strong manufacturing.

- The housing sector is on fire.

- COVID – fewer deaths, closer to vaccine.

- Surprising earnings resilience.

- 2020 is not 1999. We have optimism, not euphoria.

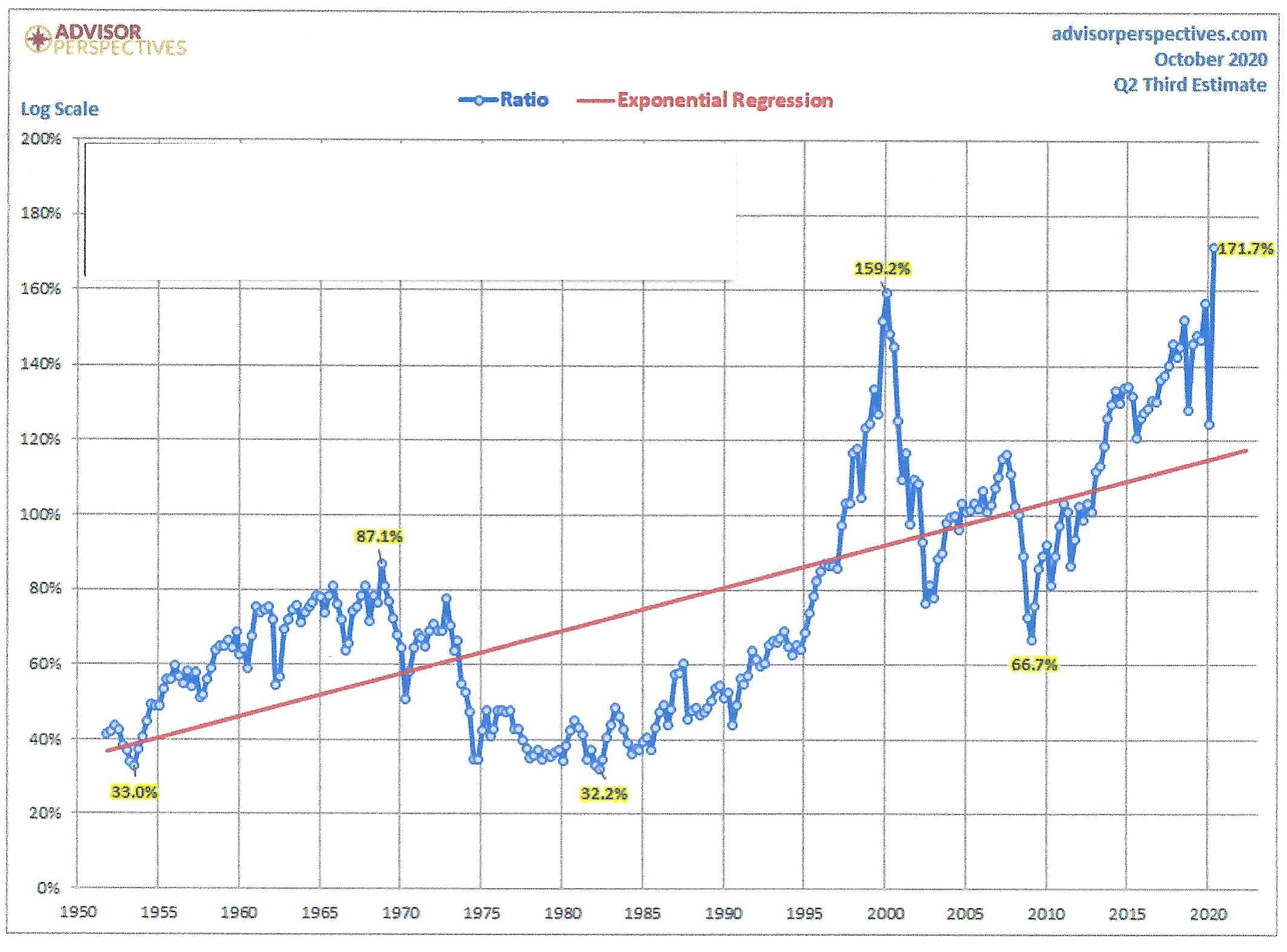

CONS

- Valuations are stretched – the highest since 1999. The graph below is Warren Buffet’s favorite valuation indicator: the value of corporate equities divided by GDP. It is at an all-time high.

THE BUFFET INDICATOR: CORPORATE EQUITIES TO GDP

Source: Advisor Perspectives

Source: Advisor Perspectives

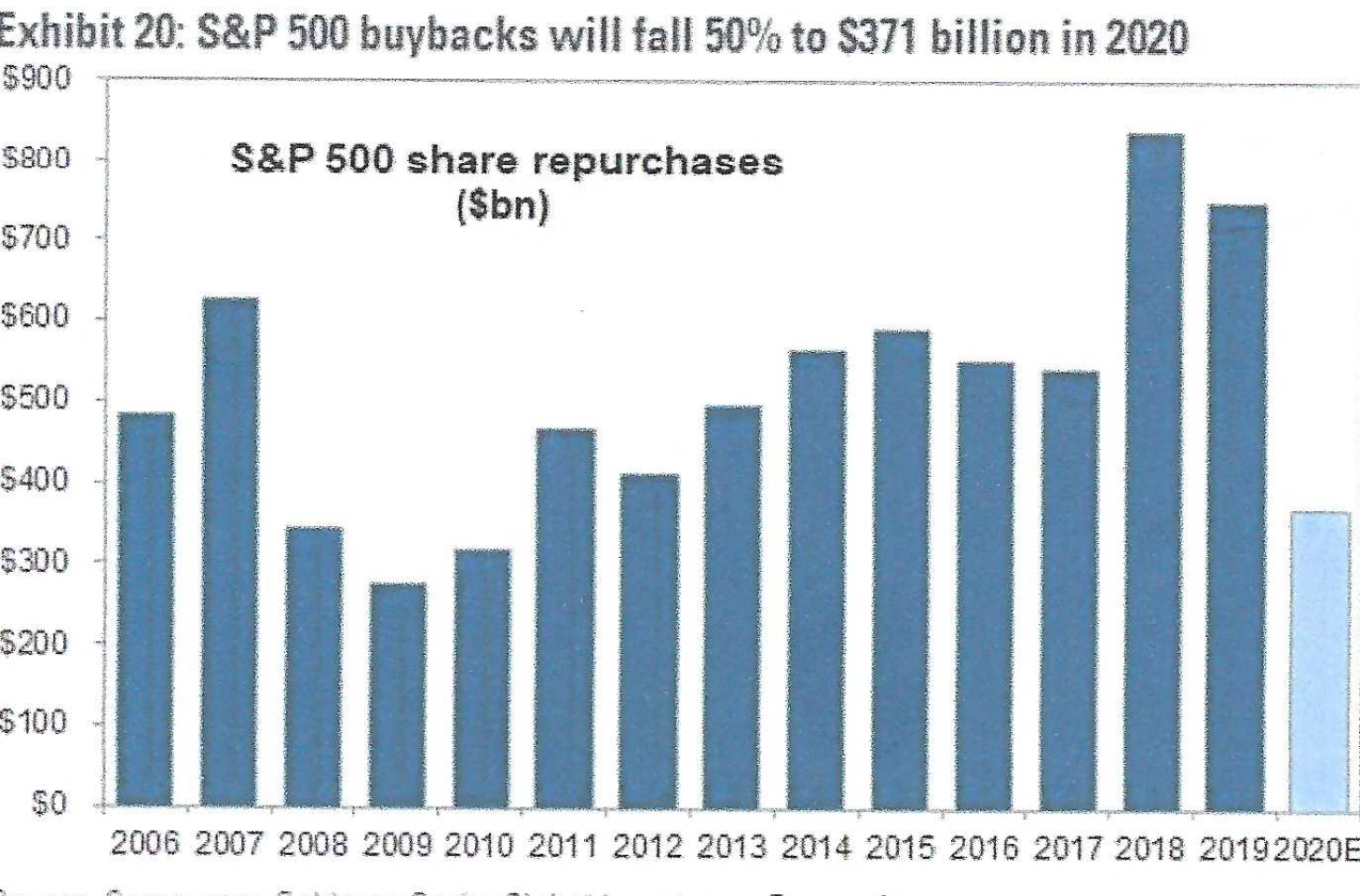

- Top-heavy market (with a concentration in technology stocks).

- The major buyer of stocks since 2009, corporations, has slowed down their purchases. The chart below shows the waterfall decline this year in stock buybacks:

Source: Compustate, Goldman Sachs Global Investment Research

Source: Compustate, Goldman Sachs Global Investment Research

- Re-emergence of the day trader.

- Slowing improvement for employment.

- COVID – still here.

- Froth in the IPO market – SNOWFLAKE is an example.

- November election.

Our list is not meant to be all-inclusive but rather a summary of the market’s key points in our view. Since we stay fully invested, one could argue that constructing this list is purely academic. However, any evidence of how our economy is actually doing during COVID, and when the economy may fully reopen is crucial to our investment strategy at the margin. Specifically, the mix among sectors and the target areas for new purchases depends on this analysis.