Last year’s zeal for risky investments was epitomized by the run-up in cryptocurrencies. For example, bitcoin quadrupled in value. The surge in bitcoin was driven by individual and institutional investors alike, many wading into the market for the first time.

Over the three years since bitcoin’s run into bubble territory in late ‘17/early’18, and then crash, investors are now more accepting of digital assets. Back then most investors (us included) weren’t sure if bitcoin was more of a currency or an asset. In this go-round, justification for owning bitcoin has been more singularly focused on its utility as a digital store of value. Proponents of bitcoin refer to it as a digital gold that can provide investors with protection from potential runaway inflation caused by the (huge) current fiscal and monetary stimulus programs.

As an aside, the first player in NFL history will receive payment in digital currency. Carolina Panthers offensive lineman Russell Okung will receive half of his base salary in bitcoin (source: USA Today).

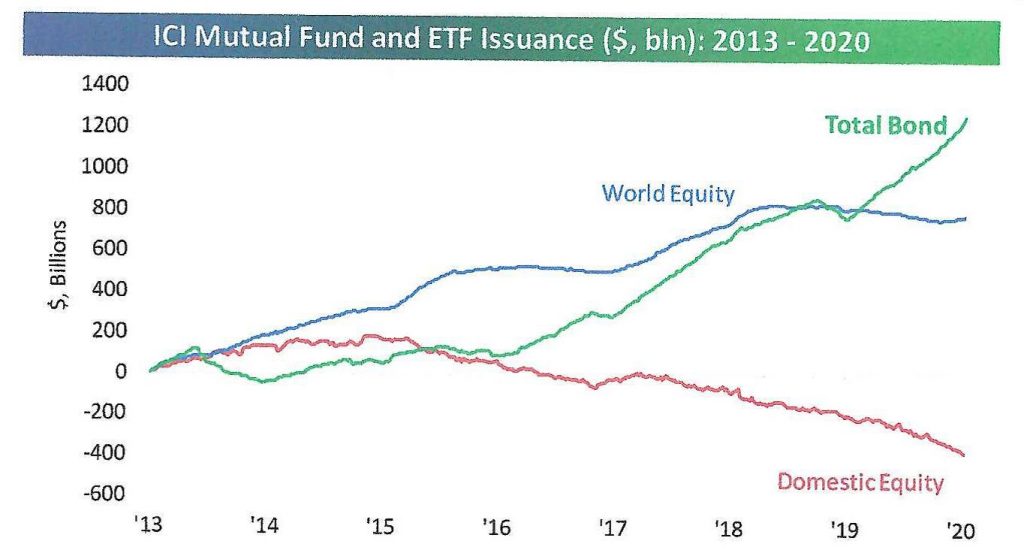

Most investor sentiment measures are flashing yellow. That is, investor views toward the market are exceedingly positive. As a contrarian indicator, this is negative for the stock market. After all, if everyone is bullish, who is left to buy? But fund flows are telling us something different. Fund flows track what investors are doing with their money. In the graph that follows, the red line (domestic equity flows) shows investors are taking huge amounts of money out of U.S. stocks:

Fund flows don’t paint nearly as rosy a picture as sentiment surveys. This is potentially bullish as some or all of these outflows could find their way back into stocks at some point in the future.

One market valuation indicator is the spread between the average share price for a stock in the S&P 500 (currently $163.60) and its price target by Wall Street analysts ($175.10). This gap represents a potential gain of 7% from current levels. At the end of 2019, the spread was even tighter than now, but at the lows on March 23rd, the average price target was 55% above the average share price. This doesn’t mean share prices can’t rise, but rather 2021 gains are likely to be modest according to this measure. Technology stocks are closest to their target prices (2%), while energy stocks show the most upside potential (15%).

THE FOLLY OF FORECASTING

It is a tradition this time of year for market participants to make predictions about what might happen to stock prices, interest rates, commodities, etc. in the following 12 months. Many of these predictions are made by very smart people with vast resources at their disposal. Yet far more often than not, these predictions end up being hilariously wrong. 2020 should have proven once and for all the futility of trying to make accurate market predictions about the future. The only reliable prediction to make is that there will be plenty of surprises in 2021.

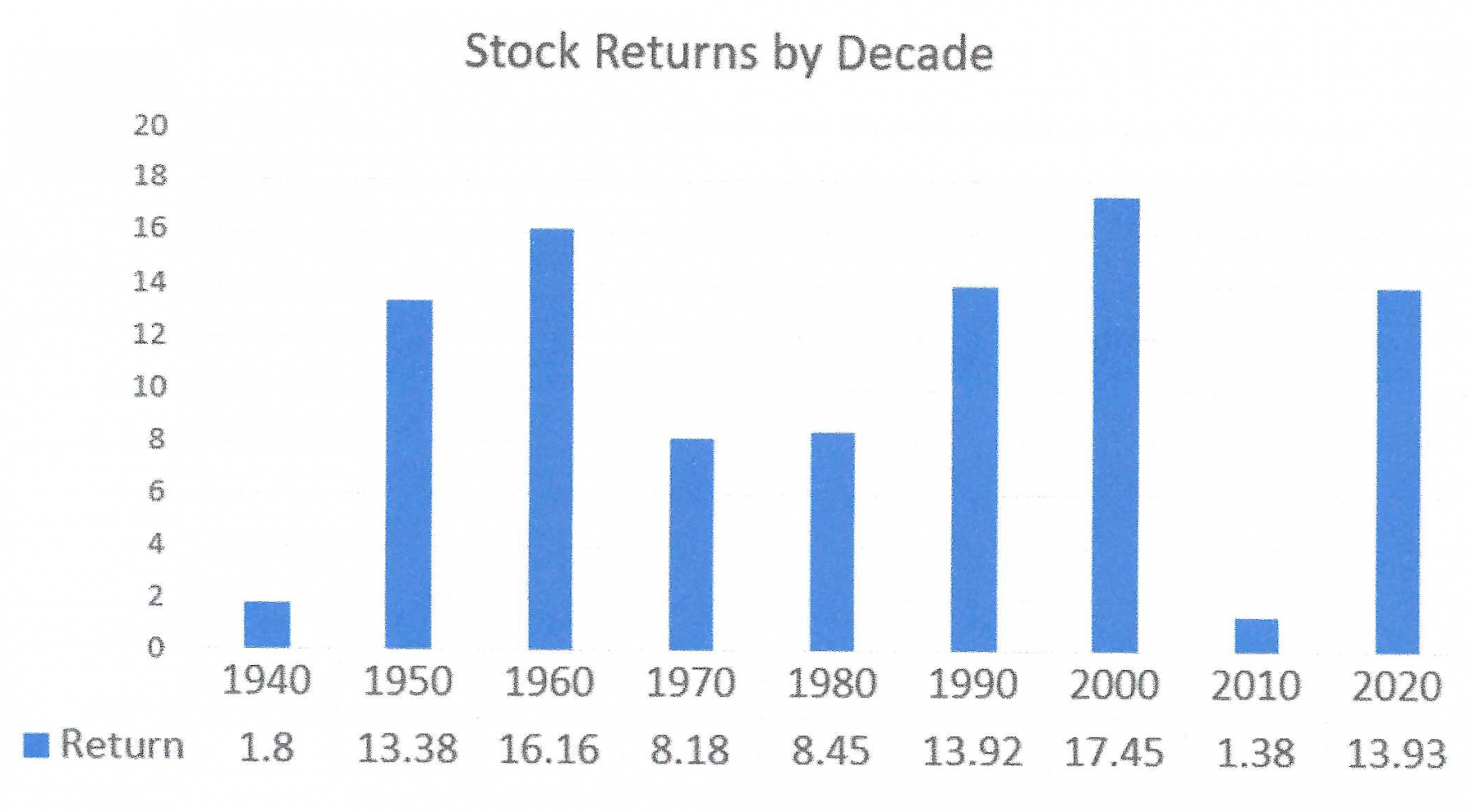

Instead, investors should focus on the power of common stocks as a wealth builder over time. But investors need to stay invested to reap the benefits of long-term equity investing and not succumb to the temptations of ‘market-timing.’ Take a look at the following bar chart which summarizes stock returns by decade going back to 1930 (the decade listed represents the end of the decade):

Source: Advisor Perspectives

The decade that just ended shows the third-highest annual return – 13.93% per year. Even the depression-era decade that ended in 1940 showed a positive annual return of 1.8%. The annual stock return for the S&P 500 is 10.3% going back 95 years.

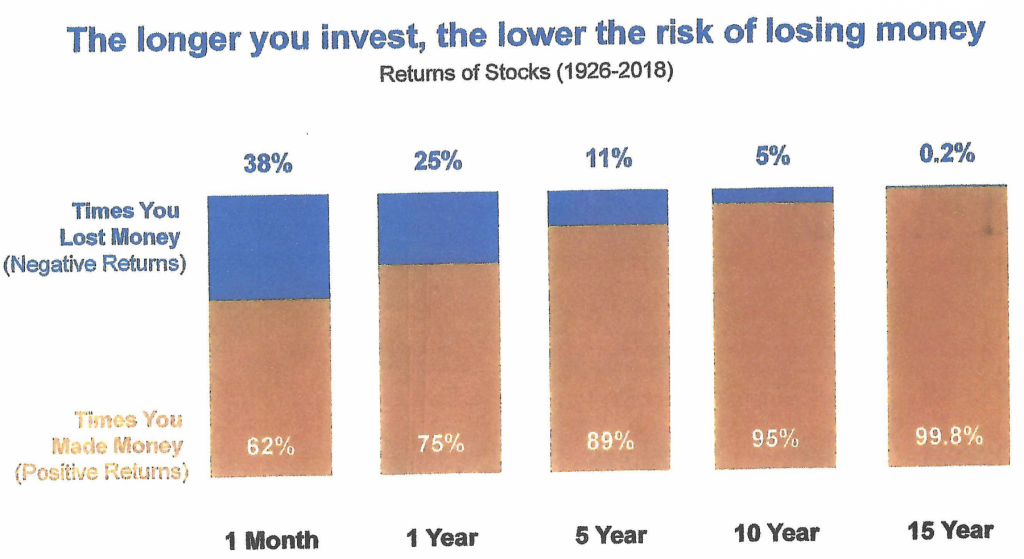

Even investors with a time horizon shorter than 95 years have an excellent chance of making money in stocks. See the bar chart below which shows the longer you invest, the lower the risk of losing money (based on S&P 500 index returns):

Source: BlackRock, Morningstar

Investors that stuck around for one year made money 75% of the time. Investors that stayed for ten years made money 95% of the time—pretty good odds.

Corrections, bear markets, and even crashes may be an unpleasant part of the investment experience but these periodic events haven’t held the market back over the longer term. Our economy is too strong and resilient to stay down for any length of time. With economic growth comes higher profits and higher share prices. Successful investing is about staying the course, not darting in and out based on the latest forecast.