- What a difference a quarter can make. Last week Fed Chairman Powell all but admitted that he and the Fed were wrong raising the Fed funds rate in December and all but called off interest rate increases in 2019. They expect one increase in 2020. The initial market response was positive because of the Fed’s dovish tone. However, soon the market sold off after more fully considering the Fed’s downgrade of both the U.S. and global economy. In some respects, it looks like an overreaction since this year’s Q1 forecast of 1.1% U.S. GDP growth is expected to rebound to a healthy 2.7% in Q2. We question how much damage the Fed did to 2019 growth with its December mistake.

- Are we in for an earnings recession in 2019? We will come close. This year’s earnings growth estimates have come down sharply since last fall, but the bleeding has stopped for now. The anticipated quarterly growth rates are Q1 -1.5%, Q2 +1.1%, Q3 +2.6%, and Q4 +9.4%. What’s causing the slowdown from 2018’s stellar growth? Profit margins have declined from 12% in early 2018 to 10.7% currently. Investors have enjoyed a sweet ride on the way up because of rising margins due to the reduction in labor’s share of the economy, the decline in corporate taxes, and big companies increased market share (lowering costs through greater scale). The downhill ride could be bumpy.

- AAII bullish sentiment remains fairly low at 37%. Until it rises above 50%, we are not concerned about too much enthusiasm for the stock market.

The Fourth Industrial Revolution

We don’t typically invest in embryonic companies or industries. Rather our investment focus is on larger, more established companies that are among the leaders in their industries. But we are always on the lookout for ‘new economy’ investment opportunities with large potential.

The investment research firm S&P Kensho has done extensive work on investment ideas for the new economy and analyzes how best to profit from today’s fourth industrial revolution. We will present some of the ideas we find most interesting.

Revolutions usually cause economic disruption. S&P Kensho states that prior industrial revolutions have caused significant disruption to the way people lived. However, in each case, “the net result has been an expanding, healthier, and wealthier fully-employed population,” according to S&P Kensho.

Here is a summary of the first three industrial revolutions which includes both major advancements and labor displacement:

- The first industrial revolution, 1760-1850, can be characterized by mechanization, steam power, power looms, and urbanization. Approximately 25% of agriculture jobs were lost to industry.

- Next, the second revolution, 1870-1914, saw electrification, mass production, assembly lines, and migration. Twenty-one percent of the labor force leaves agriculture.

- The third industrial revolution, 1969-2010, provided digitalization, automation, communication, and globalization. Twenty percent of the global workforce shifts to services.

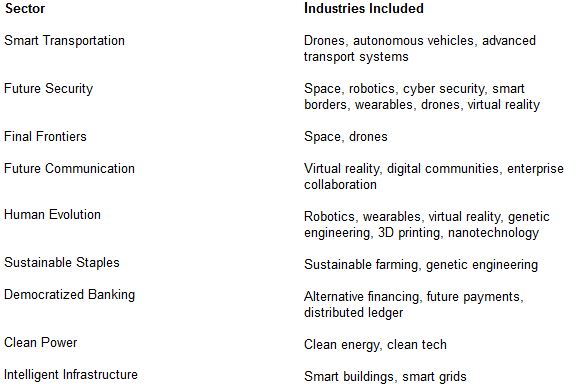

We are now at the beginning of the fourth industrial revolution which is powered mostly by advanced science and technology research and innovation. Here is a partial list of new economy industries:

We continue to look for smart ways to invest in futuristic businesses–although the future is already upon us. For example, the Space Economy, which includes consumer TV, ground equipment, and government, is already a $368 billion industry (source: CNBC, Morgan Stanley). Further progress in space is expected along this timeline:

- 1-2 years–next generation GPS, space tourism, space defense

- 2-10 years–planning for cargo mission to Mars, private lunar missions, third generation space stations

- 10+ years–colonization of Mars, mining the asteroid belt, deep space exploration

Our preferred method of investing in these new frontiers is through larger companies that have the financial resources to withstand the uncertainty of new markets and the technology to make new ideas come to life. For example, Boeing and Lockheed Martin are both very active in the space industry, but their main businesses (and funding mechanism for future businesses) are in other areas–defense and aircraft, for example. As time goes on, more of their business will come from new economy products and services.

Research and investing in 21st century new economy industries is exciting because much of this new technology will change peoples’ lives–just like the internet changed our lives.