THE NEW BULL MARKET AT DOW 30,000

It took less than four years for the Dow Jones Industrial Average to climb from 20,000 to 30,000 (Jan 2017 – Nov 2020). This is remarkable given the volatility over this same time period, including a few plunges to the downside.

Here is the pervasive bull case: Pandemics are transient events. With multiple vaccines set for production beginning this month, the end of this transient event is in sight. Businesses forced to cut costs will emerge more efficient on the other side. Massive fiscal stimulus will continue to percolate through the economy. Earnings should recover quickly (see below), and growth should return to or exceed pre-Covid levels. Perpetual low-interest-rate policy warrants higher P/E multiples. And the Fed has our back buying risk assets. There are lots of assumptions here, but if all of the above are wrong, investors know stocks go up over time.

The earnings assumptions for the next few years are key. Investors are already looking out to calendar 2022 with admittedly little visibility. Here are the consensus estimates:

|

|

S&P 500 CONSENSUS EARNINGS GROWTH % |

S&P 500 CONSENSUS SALES GROWTH % |

S&P 500 CONSENSUS EARNINGS |

CURRENT/FORWARD P/E MULTIPLE |

|

2020 |

(16.7)% |

(2.6)% |

$137.45 |

26.6 |

|

2021 |

24.2% |

7.9% |

168.42 |

21.7 |

|

2022 |

12-14% |

3-5% |

192.07 |

19.1 |

Source: FactSet

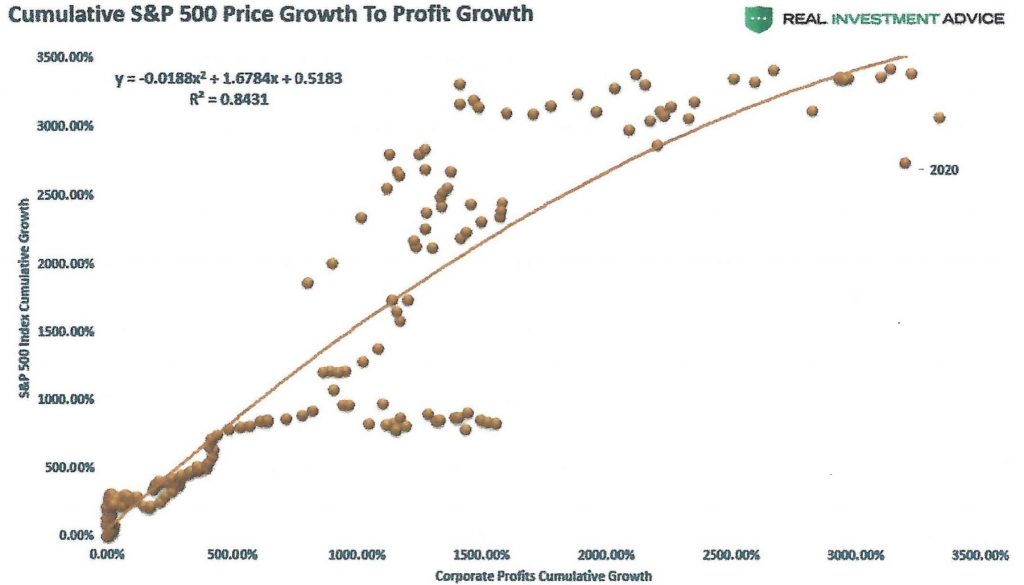

We have reminded readers over the years that stock prices follow earnings. In fact, one study shows an 84% correlation between the S&P 500 and corporate profits growth, as shown below.

Source: Advisor Perspectives, Real Investment Advice

We are clearly in a bull market, but is it a new bull market or the old one that emerged from the Great Recession in 2009? This has important ramifications for what stock categories are likely to do best over the next few years. There is increasing evidence this is a new bull market. First, value stocks, especially the more cyclical ones, caught fire in November. This is consistent with early bull market behavior. Next, emerging markets are performing well, the first time they have outperformed the U.S. market in a decade. Finally, small caps (Russell 2000), another early cycle indicator, rose almost 19% last month alone and have outperformed the S&P 500 since the low in March. One of the knocks against investing in small caps is the fact with so many ‘zombie’ companies in the Russell 2000, it is not attractive on a valuation basis (zombie companies are those that lose money). When you include all companies in the index, the Russell 2000 doesn’t even have a P/E because overall earnings are negative. However, stripping out the losers, the median P/E is about 19.3, actually less than the S&P 500.

We are predominantly a large-cap core manager that buys both growth and value stocks, but our next purchases may tilt towards value stocks, large-cap U.S. multinationals for the emerging markets exposure, and an occasional smaller stock. As mentioned earlier, all are areas that typically do well early in a bull market.

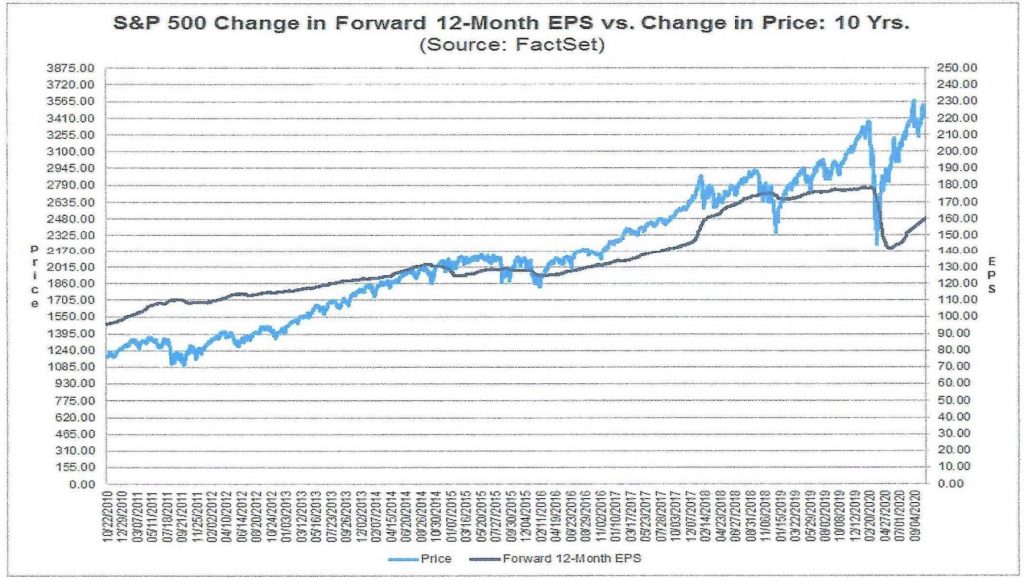

Of course, the market is not without its warts. First, the S&P 500 price level may simply be too far ahead of earnings. Prices and earnings often rise in unison, but notice the current wide gap between the two lines in the chart below. The lighter blue line (S&P 500 index price) is well above the darker blue earnings line (overvaluation).

Also, sentiment measures are flashing red. The ratio of insider sales to purchases shot up to a stunningly high 58:1. While many insider sales are pre-planned, execs tend to buy low and sell high. Other sentiment measures include CNN’s Fear and Greed Index which is in ‘extreme greed’ territory. Investors Intelligence has a spread of 40 percentage points of bulls over bears, a sign that tends to be seen at market tops.

It will be interesting to see how the markets perform in the next few months after November’s surge. One thing we can always count on is that the markets will be messy. Famed investor Seth Klarman reminds us that investing can be facilitated by science, but markets are living, breathing reflections of human actions and emotions. They don’t move in neat, regular cycles like the tides or the seasons. They are quirky and unpredictable, just like we are.