- Within the S&P 500, we continue to see a huge performance divergence between the largest and smallest stocks. Through last Friday, the cap-weighted S&P 500 was down under just 1% YTD, but the equal-weighted index was still down more than 10%. (A cap-weighted index places more emphasis on the largest stocks.) At the current spread of over ten percentage points, there has never been another year where one of the indices was outperforming the other by a wider margin. The graph below, as shown by the rising line, confirms that FANG+ stocks (the largest market caps in the S&P 500) are vastly outperforming the rest of the S&P 500. This is a case of two very different markets within the same index.

- Another disconnect in the stock market is the large difference between investor sentiment measures; The Citi Panic/Euphoria Model has been in “Euphoria” mode since early May – among the longest such streaks since the 90s tech bubble. NASDAQ optimism is at its highest level since 2000. The recent Investor Intelligence survey has a bull:bear ratio over 3:1. But the AAII retail sentiment survey has not seen bullish respondents top 35% in three months. And investors have pulled nearly $60 billion from equity funds since May. These retail readings are far from showing investors’ complacency. This lack of retail buy-in (a contrarian indicator) indicates the broader market may have more room to run.

- Last week kicked off earnings season for Q2. S&P 500 earnings are expected to plummet 45% for the quarter. Earnings are expected to drop 25% in Q3. For calendar year 2020, down 21%. Investors are looking past these numbers as Wall Street is forecasting a 28% gain for 2021. However, there is very little visibility into 2021 (and even 2022). It appears to us investors are still hoping for a ‘V’ shaped recovery, even with the recent surge in coronavirus cases across the U.S.

TWELVE ONE-SENTENCE FINANCIAL RULES

Over the years we have come up with a number of simple rules and observations about investing. Most of the rules below are our own, but sprinkled in are a few we’ve come across from others we think are worthwhile.

- Personal finance can be summarized in nine words: work a lot, spend a little, invest the difference.

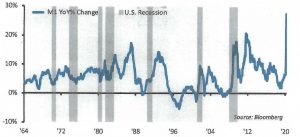

- Every five to seven years, people forget there are recessions every five to seven years.

- During the last 100 years, there have been more 10% market pullbacks than Christmases. Everyone knows Christmas will come, yet market corrections seem to surprise people.

- Holding 60% of your assets in stocks and 40% in bonds isn’t perfect for everyone, but we can think of a thousand worse strategies.

- Imagine how much stuff you would have to make up if you were forced to talk 24/7. Remember this when watching financial news on TV.

- Investors should not let Washington sway their investment decisions.Congress has been a dysfunctional swamp of disappointment since 1789, and stocks have done well ever since.

- It is strange that most people go to a doctor once a year, but they check their investments once a day.

- People should quit day trading and donate their money to charity instead—same financial result for the trader, and a better outcome for society.

- Investors were probably better informed 25 years ago when there was 90% less financial news.

- Change your mind as often as the facts change.

- Judge analysts by the quality of their arguments, not the performance of their last trade.

- Investors should read more history and fewer forecasts.