Lately, stock markets are rising or falling in substantial part on the prospects of a trade deal with China. Language has turned acrimonious with China saying they would never surrender to foreign pressure. So far, U.S. consumers haven’t felt the full effects of tariffs, which seem to have been absorbed mostly by businesses. But businesses can start to pass these additional costs to consumers causing households to pull back and shave economic growth. The ultimate cost of tariffs is hard to measure precisely because it extends beyond the tariff rate and creates uncertainty on trade and business investment decisions.

The Dow is now about 1300 points lower than when President Trump began his tariff talk in January 2018-despite the best 12 months for economic growth since 2005 and all-time record corporate profits. The market’s clear message is that tariffs will subtract from economic growth. Presidents Trump and Xi will meet next month at the G20 gathering. We remain optimistic a favorable deal will eventually get done, but at some point soon, tweets and headlines won’t cut it, and investors will demand concrete results.

When markets are fully priced as they are now, it doesn’t take much bad news for the markets to correct. The backdrop for equity prices remains favorable (strong economy, record profits, low interest rates, low inflation, job gains, etc.) but it may be difficult for the stock market to rally further given high valuations and ongoing trade tensions.

Why Balanced Portfolios Make Sense for Most Investors – Update

Our June 2016 Market Commentary (https://www.clearviewws.com/wp-content/uploads/2018/12/June-2016-Market-Commentary.pdf) compared the risk and return of all-equity and balanced portfolios going back to 1926. The goal was to determine which portfolio strategy provided investors with the best risk-adjusted return (called the Sharpe ratio). The conclusion was that balanced portfolios have lower returns, much lower volatility, but better risk-adjusted returns

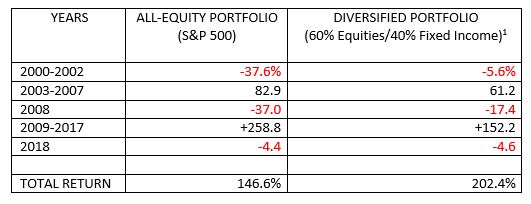

We recently came across an interesting study by Morningstar that shows actual market returns over the last 19 years for both all-equity and balanced portfolios. The results may surprise you:

1Diversified Portfolio Composition

60% Equities: 40% S&P 500

15% EAFE (foreign stocks)

5% Russell 2000 (U.S. small caps)

40% Fixed Income: 30% Bloomberg Barclays U.S. Aggregate Bonds

10% Bloomberg Barclays High-yield

Yes, the balanced portfolio outperformed the all-equity account in this period which includes a ten year bull market! How can that be?

The all-equity portfolio (S&P 500) had two very bad periods (2000-2002 and 2008) which greatly affected cumulative returns. Compounding returns with big negative numbers hurts long term performance. On the other hand, the balanced/diversified portfolio saw much smaller negative returns in the bad years which more than offset the underperformance in the good years. This is truly a case of the tortoise beating the hare.

As we noted in the June 2016 Market Commentary, “All-stock portfolios remain appropriate for those investors willing to financially and emotionally withstand higher volatility along with the increased possibility of a big down year.” But for most investors who stay invested over complete market cycles that include bear markets, balanced portfolios may be the best option.