Can investors look back at SARS in 2003 and use that market behavior to analyze how today’s markets might be impacted by the coronavirus? Probably not. Both the economic and market conditions were much different in 2003 than they are now. In 2003 we were coming out of a three-year bear market. The economic cycle was young. Today we are presumably late in the economic cycle and the bull market is aged. And China today is a much bigger factor in the world economy – their role in the global economy has more than quadrupled since then. The rate of new cases is key and must decline before the markets will breathe easier.

The coronavirus is being used as the handy excuse for last week’s equity market selloff, but two other factors are also at play. First, stocks are extended. The market needs a breather as it has had an incredible streak of higher highs and overbought conditions. A technical consolidation is taking place. Second, Bernie Sanders is surging in the polls. In our view, the sentiment shock to the markets of the potential for a socialist President is just as material as coronavirus.

About 69% of companies have beaten bottom-line Q4 EPS estimates, while 64% have beaten top-line revenue estimates. These readings are relatively strong compared to recent quarters, but two-thirds of companies have yet to report.

If we break out share price performance based on whether a stock beat or missed EPS estimates, stocks that are missing estimates are not getting punished that much, but stocks that are beating EPS estimates are barely rallying at all. This suggests the market pulled forward any positive news from earnings in the weeks leading up to the reporting period when equities were rallying.

WILL THE CORONAVIRUS DERAIL THIS YEAR’S EARNINGS RECOVERY?

Last month we wrote that 2019 was characterized by a higher multiple placed on the stock market with little earnings growth, and that we would need solid earnings growth this year to propel stocks higher – we can’t rely on further P/E expansion.

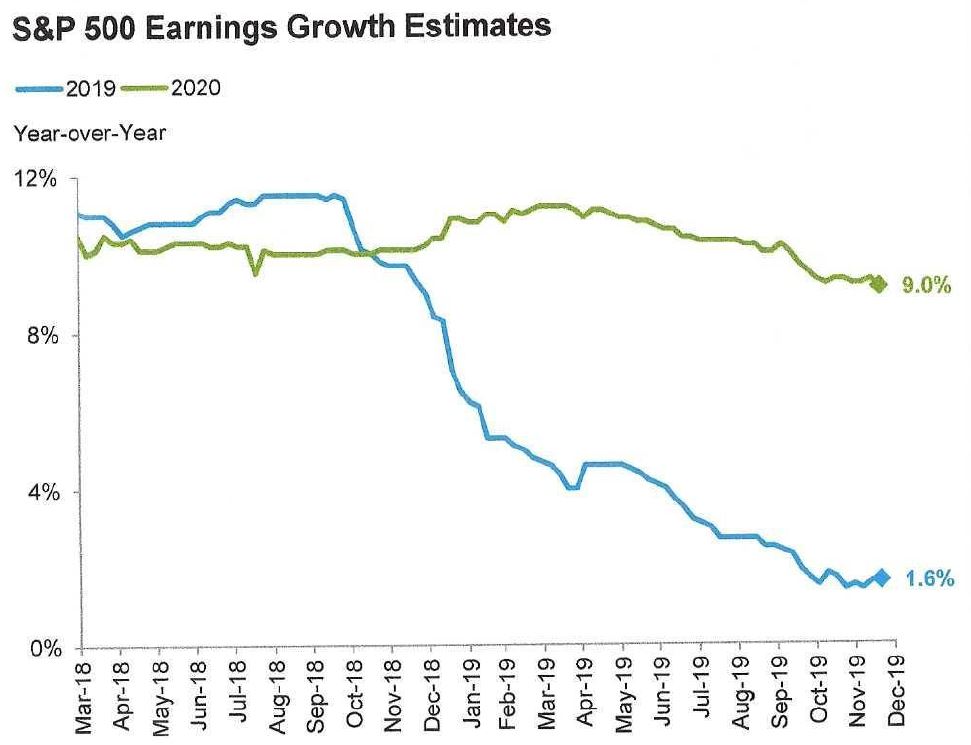

Market consensus expectations for 2020 earnings growth stands at a solid 9%. But will that be marked down by the coronavirus? Will we see a plunge in growth estimates like we did last year? The graph below shows how 2019 estimates fell beginning in October 2018 and are finally settled in at a paltry 1.6%. The graph also shows that 2020 estimates have been fairly stable for about two years.

Source: Bloomberg Finance L.P., Fidelity Investments (AART), as of 12/27/19.

Markets are starting to fear a possible start of continuous estimate cuts like last year. Will we end the year with solid high single-digit growth or something much less? As the coronavirus story unfolds, investors will have a better sense of this but it is still too early to quantify the economic impact of the virus.

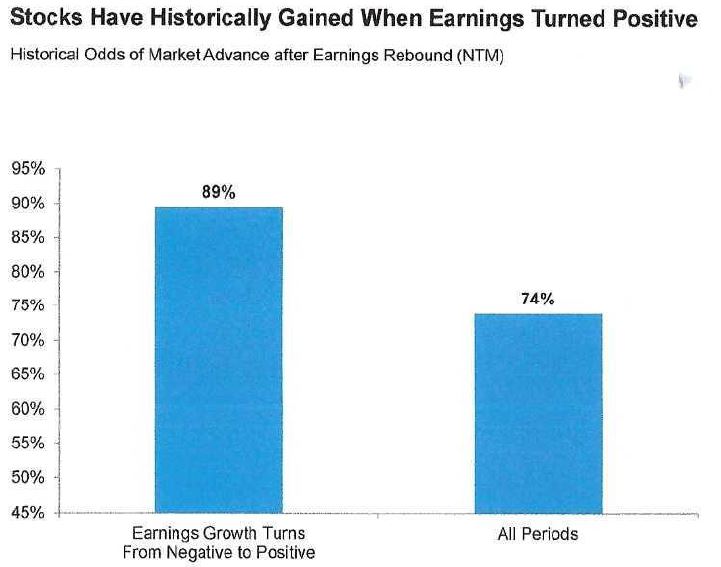

As we mentioned, investors are expecting earnings to rebound nicely this year. Rebounding earnings have been meaningful for the market historically. When earnings growth has turned from negative to positive as it has recently, the S&P 500 advanced 89% of the time. In fact, accelerations in earnings have been more important for stock performance than the level of earnings growth historically. See the bar chart below:

Source: Haver, FactSet, Fidelity Investments, as of December 31, 2019.

Source: Haver, FactSet, Fidelity Investments, as of December 31, 2019.

In summary, investors are concerned that the virus may slow our economy and put a dent in earnings. We are watching closely but, in our view, the impact to the U.S. from the virus will be limited. U.S. consumer spending is strong enough to overcome a slowdown in exports to China. We will stay with our long-term strategy and are expecting more volatility. If the broad market decline returns, attractive opportunities may present themselves in companies not impacted by a possible slowdown due to the virus.